New Report: A $3,100 state Child Tax Credit could cut North Carolina child poverty rate in half

New Report: A $3,100 state Child Tax Credit could cut North Carolina child poverty rate in half

A smaller $1,200 credit could reduce the child poverty rate by over 25%

(Nov. 17, 2022) — As the dust settles on this year’s elections and state lawmakers look toward 2023’s legislative session, they should prioritize improving a state Child Tax Credit (CTC) to dramatically reduce child poverty in North Carolina and counteract the regressive nature of our state and local tax system. A new 50-state analysis, released Wednesday on behalf of Share Our Strength by national research organizations the Institute on Taxation and Economic Policy (ITEP) and the Center on Poverty & Social Policy (CPSP) at Columbia University, finds that a well-designed CTC could help millions of North Carolinians and lift hundreds of thousands of children out of poverty.

“The expanded Child Tax Credit allowed us to see in real time the poverty-busting impact of the increased value of the credit,” said Heba Atwa, Advocacy Manager for the NC Budget & Tax Center. “Complementing the federal credit with a robust North Carolina accompaniment would mean hundreds of thousands of North Carolina kids would experience the positive impact on education, health, and well-being outcomes that generous and refundable tax credits have on children and families living in poverty. Expanding the Child Tax Credit is a common-sense, anti-poverty policy proven to improve the lives of NC kids.”

The report’s key findings for North Carolina are:

- A refundable state CTC of $3,100 with a 20 percent credit boost for young children under 6 could cut North Carolina’s child poverty rate in half and lift 166,000 kids out of poverty.

- A smaller $1,200 refundable CTC – with the same credit boost for young kids – could reduce the state child poverty rate by 25 percent and lift 83,000 kids out of poverty.

State CTCs are gaining steam after the federal expansion of the credit was shown to be enormously successful in reducing child poverty, cutting it by more than 40 percent in 2021. Heading into 2023, ten states currently have some form of a Child Tax Credit and many others are considering one — North Carolina currently offers a very small, nonrefundable CTC with a maximum credit of just $125 for families with very low incomes. This report also outlines key policy design principles that will help lawmakers, advocates and other stakeholders understand how to reduce poverty through well-designed, effective and inclusive state CTCs.

“As we’ve seen at the federal level, a robust CTC is extremely effective in helping families struggling to put food on the table, pay their bills and make ends meet,” said Aidan Davis, ITEP’s State Policy Director and a co-author of the report. “State lawmakers can enact or expand these credits to chip away at racial and wealth inequality, blunt some of the regressivity of state and local tax systems and help families meet their basic needs.”

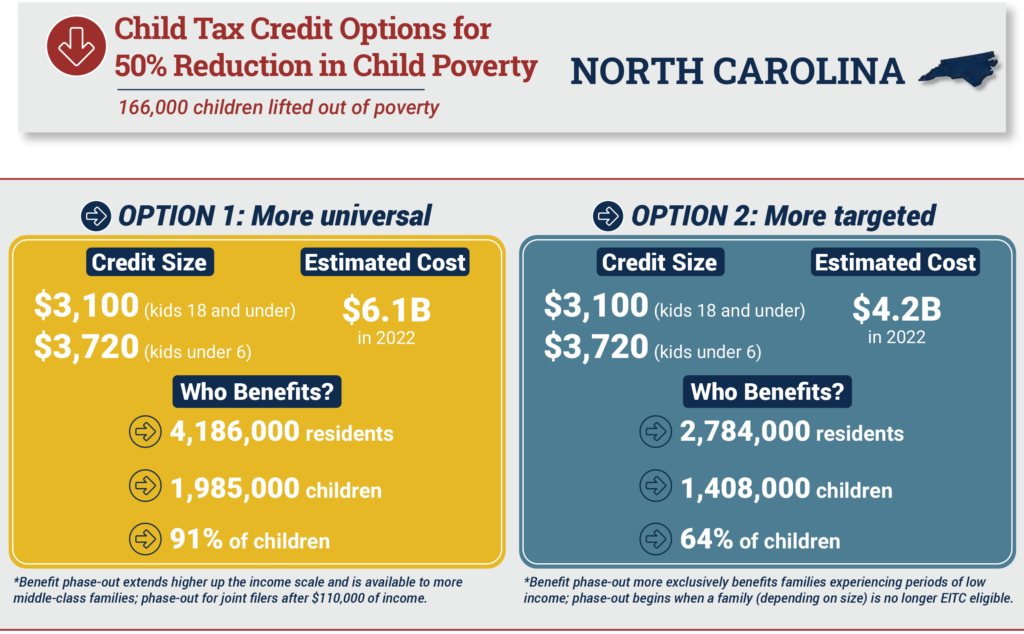

For both 25 and 50 percent poverty reduction, this report shows options for a more universal CTC (that extends higher up the income scale and is available to more middle-class families) and a more targeted CTC (that is designed to direct benefits primarily toward families experiencing periods of low income). In North Carolina:

- A refundable state CTC of $3,100 – the one that would cut the state’s child poverty rate in half – would benefit between 1.4 million and 2 million North Carolinian children – or between 64 and 91 percent of all kids, depending on the design elements above.

- A refundable state CTC of $1,200 – the one that would cut the state’s child poverty rate by 25 percent – would benefit between 1.3 million and 1.8 million North Carolinian children – or between 57 and 83% of all kids, depending on the design elements above.

- The total cost of such a bold, robust state CTC – depending on all the design elements above – would be between $1.5 billion and $6.1 billion.

“In 2021, state and local governments saw how the federal CTC expansion improved the lives of their constituents by bolstering family income and reducing poverty, food insecurity, and financial hardship,” said Sophie Collyer, CPSP Research Director and a co-author of the report. “This report shows that state governments have an opportunity to achieve the same outcomes by establishing robust and thoughtfully-designed state CTCs.”

Child Tax Credits have enormous benefits for states, with great potential to significantly reduce child poverty in all states while also addressing economic and racial inequities that are too often made worse by regressive state taxation. Well-designed CTCs boost the after-tax incomes and economic security of a diverse group of families and can be particularly important for Black, Hispanic, Indigenous, and other people of color confronting the economic hardships created by systemic racism.

“The 2021 federal enhancements to the Child Tax Credit had a measurable and significant impact on child poverty,” said Lillian Singh, Senior Vice President at Share Our Strength. “Expanding these credits is too important of an opportunity to miss. This new report underscores the critical chance states have to build momentum for state CTCs so more families have the resources they need and the ability to chart a pathway out of poverty.”

For more information, contact Heba Atwa, Advocacy Manager for the NC Budget & Tax Center, at [email protected], 919-670-3438; or Jon Whiten, ITEP, at [email protected], 917-655-3313.

The NC Budget & Tax Center is a non-partisan organization that works to document fiscal and economic conditions in communities to support the work of people, organizations, and government to advance solutions to poverty and pursue racial equity.

The Institute on Taxation and Economic Policy (ITEP) is a non-profit, non-partisan tax policy organization that conducts rigorous analyses of tax and economic proposals and provides data-driven recommendations on how to shape equitable and sustainable tax systems. ITEP’s expertise and data uniquely enhance federal, state, and local policy debates by revealing how taxes affect both public revenues and people of various levels of income and wealth.

The Center on Poverty and Social Policy at the Columbia School of Social Work produces cutting-edge research to advance our understanding of poverty and the role of social policy in reducing poverty and promoting opportunity, economic security, and individual and family wellbeing. The center’s work focuses on poverty and social policy issues in New York City and the United States.

At Share Our Strength, we’re ending hunger and poverty – in the United States and abroad. Through proven, effective campaigns like No Kid Hungry and Cooking Matters, we connect people who care to ideas that work.

We’ve put the contact information for each of our team members on our website at NCBudget.org/our-team/, or you can always email us at [email protected] if you’re not sure who to talk to. You can also follow our blog at NCbudget.org/blog.