Research & Data

Types

Featured

Topics

A refundable Child Tax Credit would help NC children thrive

Download a PDF of the Fact Sheet here No matter where we come from or what we look like, we all want to provide for our children and give them every opportunity to thrive. In 14 states across the country, legislatures have adopted child tax credits that reduce child poverty, improve wellbeing, and make state…

Recognizing the Contributions of Working Families to NC’s Economy and Communities

Working families across North Carolina contribute to our state’s economy every day through their labor in essential roles, from grocery store workers to home health aides to early childhood educators. At the same time, North Carolina’s upside-down tax code asks these families to play an outsized role in funding the public services we all want…

Local tax credits are delivering for families nationwide, but not in NC

A recent report from the Institute on Taxation and Economic Policy (ITEP) is timely, then, in lifting up the potential of local governments to make transformational investments in working families through innovative policies like a local Earned Income Tax Credit. While the use of these local credits is currently blocked by state law in North Carolina, their effectiveness is a reminder of what might be possible if legislative leaders pursued policies to deliver well-being to communities across NC and empowered local governments to do the same.

North Carolina’s poverty rate is a policy choice

The latest poverty data from the U.S. Census Bureau released last month shows that more than 1.3 million North Carolinians — including more than 380,000 NC children — were living below the federal poverty line in 2022. For a family of four, this is the equivalent of $27,750 in household income in a year — resources so low that families are forced to make impossible choices among buying groceries, paying rent, and meeting basic health care needs.

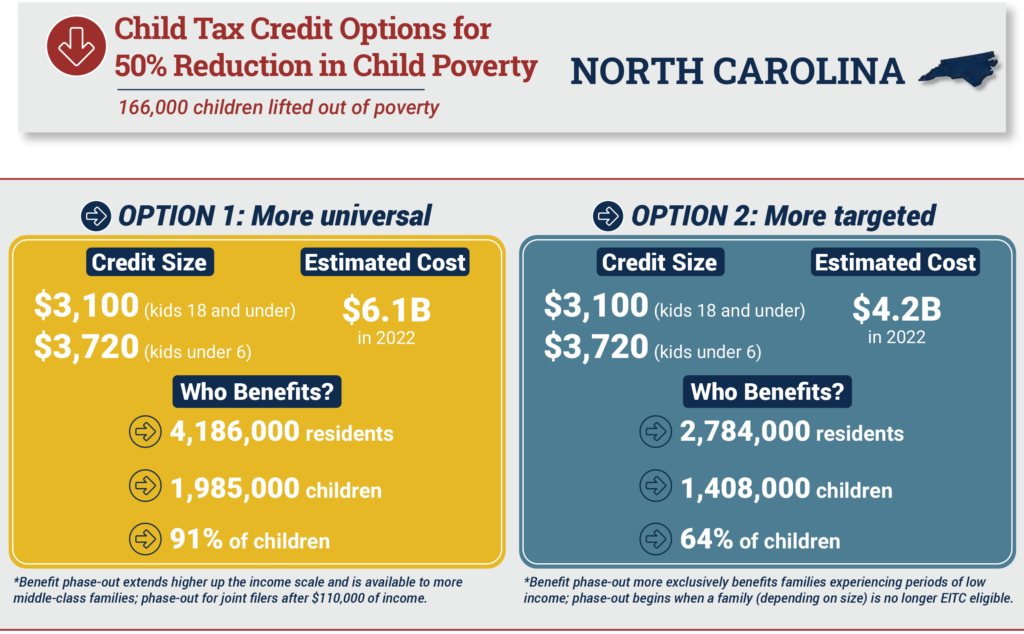

New Report: A $3,100 state Child Tax Credit could cut North Carolina child poverty rate in half

New Report: A $3,100 state Child Tax Credit could cut North Carolina child poverty rate in half A smaller $1,200 credit could reduce the child poverty rate by over 25% (Nov. 17, 2022) — As the dust settles on this year’s elections and state lawmakers look toward 2023’s legislative session, they should prioritize improving a state…

Unemployment Insurance worked, but NC workers who needed it most didn’t see the full benefit

North Carolina could have benefited even more if our state’s Unemployment Insurance policies were in line with what is needed to stabilize households and local economies during hard times. In 2013, state policymakers made changes that reduced the effectiveness of the program. Today, North Carolina’s Unemployment Insurance continues to provide too few dollars in wage replacement for too short a time for too few of the workers who have lost their jobs.

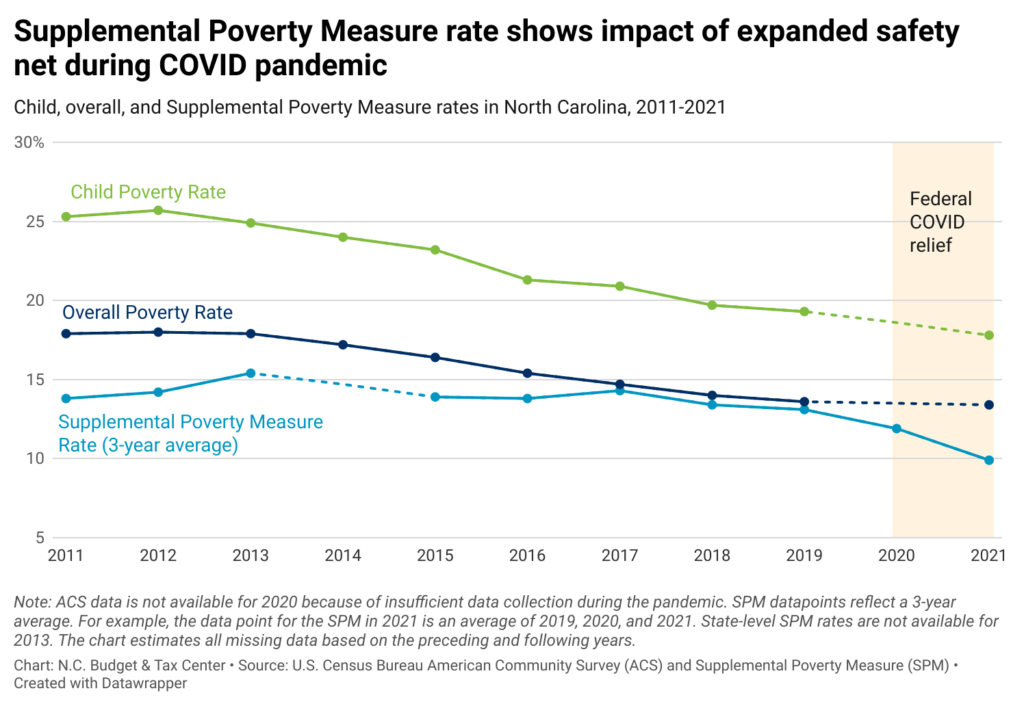

Federal COVID-19 aid averted financial disaster for many North Carolina families

New data released last week from the U.S. Census Bureau’s Current Population Survey and American Community Survey (ACS) point to the critical impact that federal relief had on the well-being of children and families in 2021.

New poverty data: Federal COVID-19 aid averted financial disaster for many North Carolina families

Poverty data for 2021 show some of the impacts of federal aid during COVID-19. (Sept. 15, 2022) — Poverty statistics released today from the U.S. Census Bureau’s American Community Survey show some of the vital help that federal COVID aid delivered to North Carolina families. Instead of seeing financial hardship explode due to economic disruptions caused…

Increase in NC’s Work First cash assistance program would help families meet basic needs

North Carolina’s Work First program benefit has stayed the same since 1996, even as the costs of rent, food and other basics have increased. A program that is meant to provide support to households in crisis and struggling to move out of poverty provides such meager cash assistance that families are still left below the poverty line.

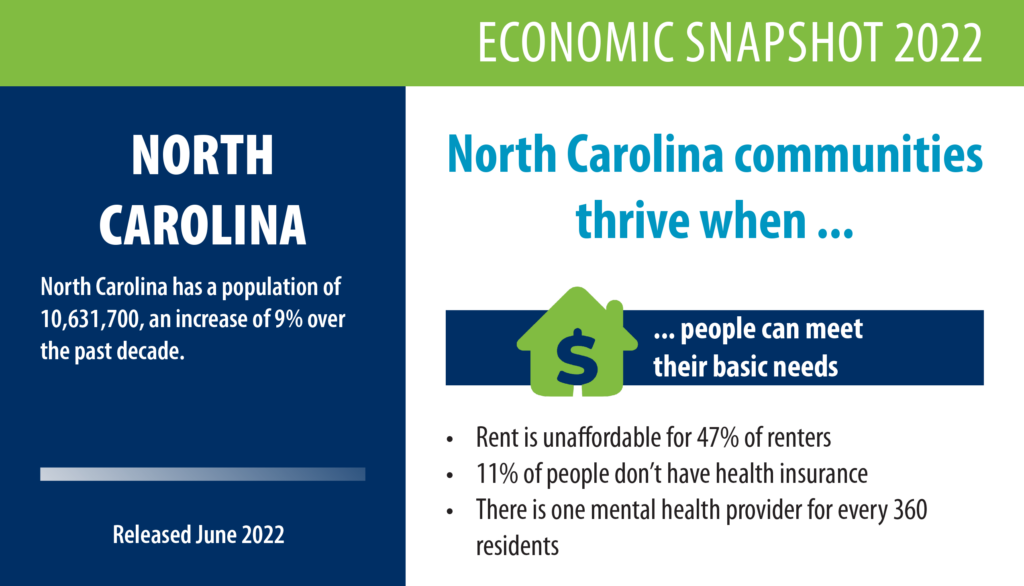

Economic County Snapshots 2022

The NC Budget & Tax Center publishes Economic County Snapshots every year that include indicators for each county in NC on employment, poverty and income, housing, health, education, and supports for working families — all of which come from a variety of sources.