Having more revenue than expected is not the same as having the revenue we need

Each year, the North Carolina Office of State Budget Management (OSBM) and the Fiscal Research Division (FRD) release a Consensus Revenue Forecast that projects how much tax revenue the state can expect to collect. The forecast represents an agreement — that’s the “consensus” part — between the legislative and executive branches about how much money the state has to work with in creating a balanced budget.

This year’s forecast was released last week, and most headlines will focus on the fact that North Carolina is projected to collect $1.4 billion more than expected over Fiscal Years 2024 and 2025. Far from a cause for celebration, though, the forecast is a sobering reminder of the consequences of legislative leaders’ relentless pursuit of tax cuts for corporations and the wealthy: revenue collections that fall short of current needs and a trajectory that calls into question the state’s future ability to fund the public institutions that help our communities thrive.

Anticipated overcollections won’t cover NC communities’ needs

Before we allow legislative leaders to crow about this forecast, we should be clear that the additional anticipated revenue won’t come close to covering unpaid bills, meeting current obligations, and covering the backlog of needs in North Carolina communities.

The unexpected funds in just this current fiscal year won’t cover the amount that is past due to the state’s public education system as part of the Leandro case. According to court rulings, the state still owes $678 million to fund two previous years — Fiscal Years 2022 and 2023 — of the eight-year Leandro Plan and uphold its constitutional obligation to provide a sound basic education to North Carolina children.

Legislative leaders also passed policies last year that they have yet to fully fund. For example, there is a $300 million gap in the state’s flawed private school voucher program. Last year, the legislature made the program universal by expanding eligibility to families of any income level and any school enrollment history – including millionaires whose children never attended public school.

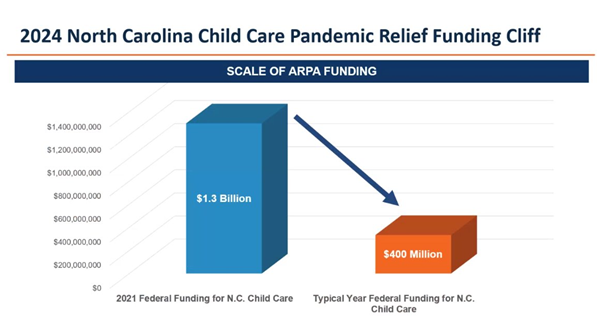

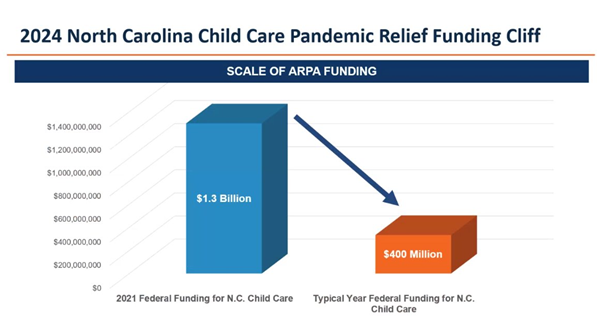

The looming crisis in North Carolina’s childcare system also underscores that an ongoing commitment — not modest overcollections — will be required to meet long neglected needs. The childcare system faces an impending fiscal cliff this summer due to the loss of federal pandemic-era funding. While the drastic needs of the system should be immediately met with these additional tax dollars, we know that structural issues make childcare in our state an unsustainable business model. A lasting solution will require not only this downpayment, but a sustained investment to finance a system that delivers quality care in every county with living wages for educators.

Source: Data presented to the Joint Legislative Oversight Committee on Health and Human Services by the Division of Child Development and Early Education, February 2024

Policy that caters to the wealthy few instead of addressing the multiple crises facing regular North Carolinians is the wrong way to go. Instead of paying for private school for millionaires, public funds could meet the systemic needs of our communities: supporting healthy pregnancies and child development, preserving and expanding affordable housing, protecting our state’s environmental resources, and so much more. The revenue forecast shows that we can choose to make a recurring commitment to the well-being of families and communities.

Forecast signals concerning future for NC revenue growth

While legislative leaders will attempt to direct attention to upward adjustments in tax collections, the number that should stick in North Carolinian’s minds from this forecast is the year-over-year revenue growth projected for FY 2024-25: a mere 0.7%.

That means that when the legislature comes back for their next long session in 2025, forecasters’ best guess is that they’ll only have 0.7% more tax dollars to work with than the previous year. Any North Carolinian that has struggled to make wages keep up with rising costs knows that 0.7% growth won’t fit the bill when annual inflation is hovering around 3.5%.

This low level of growth continues a worrying trend. Before the Great Recession, the state averaged nearly 9% revenue growth each year. Since 2013 — the year that the legislative majority began its march towards zero income tax — year-over-year growth has averaged under 6%, even when including a large and anomalous spike in funds during the COVID-19 pandemic.

The reason this year-over-year growth is so low, according to the forecast itself, is previously enacted tax cuts, including reductions in the personal income tax rate and the corporate income tax rate that will eventually cost the state more than $13 billion each year. In other words, revenue growth is expected to slow, not because of any economic slowdown anticipated by forecasters, but because of tax choices made by legislative leaders that disproportionately benefit the wealthy few at the expense of our public institutions.

North Carolina still has time to choose communities over corporations

The revenue forecast should prompt policymakers to pause planned tax cuts and proceed with caution, rather than congratulate themselves on modest overcollections. As lawmakers return to Raleigh to consider adjustments to the state budget, North Carolinians should be demanding a course correction. It’s time for our tax and budget policy to respond to the needs of regular North Carolina communities, not the pocketbooks of the rich and corporations.