NEW POLL: North Carolinians reject tax cuts for profitable corporations and the wealthy few, want legislators to fund people’s priorities

National interests have long been meddling with our state’s tax code to advance their agenda of removing the responsibility the wealthy and profitable corporations have for contributing to the public good.

From the Tax Foundation to the Wall Street Journal to Americans for Tax Reform, our state has garnered accolades because policymakers have followed their directives for policymaking.

But things are not fine in North Carolina.

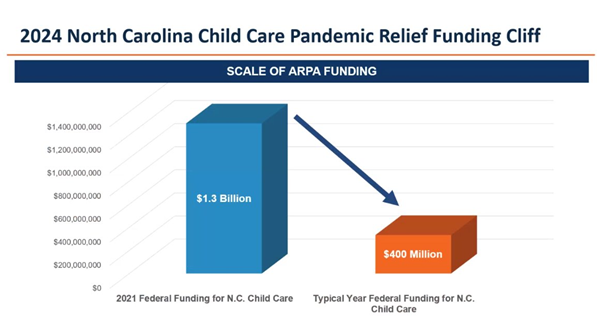

North Carolinians are unhappy with the state of the economy, and they are confronting the daily realities of underfunded public systems—from the lack of bus transportation for public schools to childcare center closures to out-of-reach training for the jobs of the future.

New polling confirms, as well, that North Carolinians don’t agree with their approach to how we can build a strong economy. An overwhelming share of North Carolinians (77 percent) reject the elimination of the corporate income tax, which is slated for 2030.

Voters’ rejection of the “march to zero” income taxes that North Carolina policymakers have pushed since 2013 demonstrates the need for a different way forward.

North Carolinians (70 percent) want to see a state budget that invests more in education, infrastructure, and health care for the people, even if that means the wealthy and profitable corporations have to pay more in taxes.

North Carolinians also want to see economic policies that level the playing field and do more to create a fairer economy for those living in poverty.

The good news is that policymakers can make policy that meets North Carolinians’ vision for the economy.

- Policymakers can stop the elimination of the corporate income tax. They can keep the current rate, which is already low at 2.5 percent.

- Policymakers can enact a state-level Child Tax Credit that cuts child poverty by a third.

- Policymakers can recognize the outsized contributions in state and local taxes that come from working families and establish an Earned Income Tax Credit.

To do so, elected leaders need only reject currying favor with national interests in favor of a policymaking process informed by the interests of the people in this state and in their district.

For the economic rules to work for North Carolinians, we need elected leaders who recognize that they work for us.