Sally Hodges-Copple

Posts by Sally Hodges-Copple

Slide deck: NC General Assembly Session Summary 2025

The NC General Assembly is done for the year. They missed the mark on addressing North Carolina’s priorities this session. Check out this slide deck summarizing the 2025 Long Session and where legislative leaders fell short. Download the PDF here.

North Carolina General Assembly should pause next year’s tax cuts and instead invest $1B in affordability priorities

Unless leaders in the North Carolina General Assembly change course before the end of the year, Jan. 1 will bring unhappy news for North Carolinians fed up with the rising cost of living. That’s the date that yet another round of state tax cuts goes into effect, with the personal income tax rate dropping to…

Mapping What’s at Stake: The Impact of SNAP on North Carolina’s Families and Local Economies

Every county in North Carolina benefits from federal food assistance. Each month, SNAP (aka food stamps) dollars flow into every community, helping families put food on the table and keep up with rising costs. They also keep local grocery stores open, support jobs, and strengthen local economies. That critical support is now at risk. Without…

Beyond the Census data: How policy shapes well-being in NC

In September 2025, the US Census Bureau released annual data on poverty, income, and health insurance coverage for 2024. This resource will walk you through key data points for North Carolina and the public policy choices that influence these outcomes. Poverty How high is the poverty rate in North Carolina? New data from the U.S….

Public Comment: Work First TANF State Plan

To: Allison W. Smith, Deputy Director Division of Social Services Economic and Family Services NC Department of Health and Human Services 2420 Mail Service Center Raleigh, NC 27699-2420 From: NC Budget & Tax Center PO Box 25374 Durham, North Carolina, 27702 RE: Work First TANF State Plan Public Comments Dear Deputy Director Allison…

NC lawmakers haven’t passed a comprehensive state budget. What does that mean for me?

Two months into the new fiscal year and following the start of another school year, legislative leaders in North Carolina still haven’t passed a comprehensive state budget. Here’s what that means for you and your community. What happens if lawmakers don’t pass a budget? Does state government shut down? No. If lawmakers fail to pass…

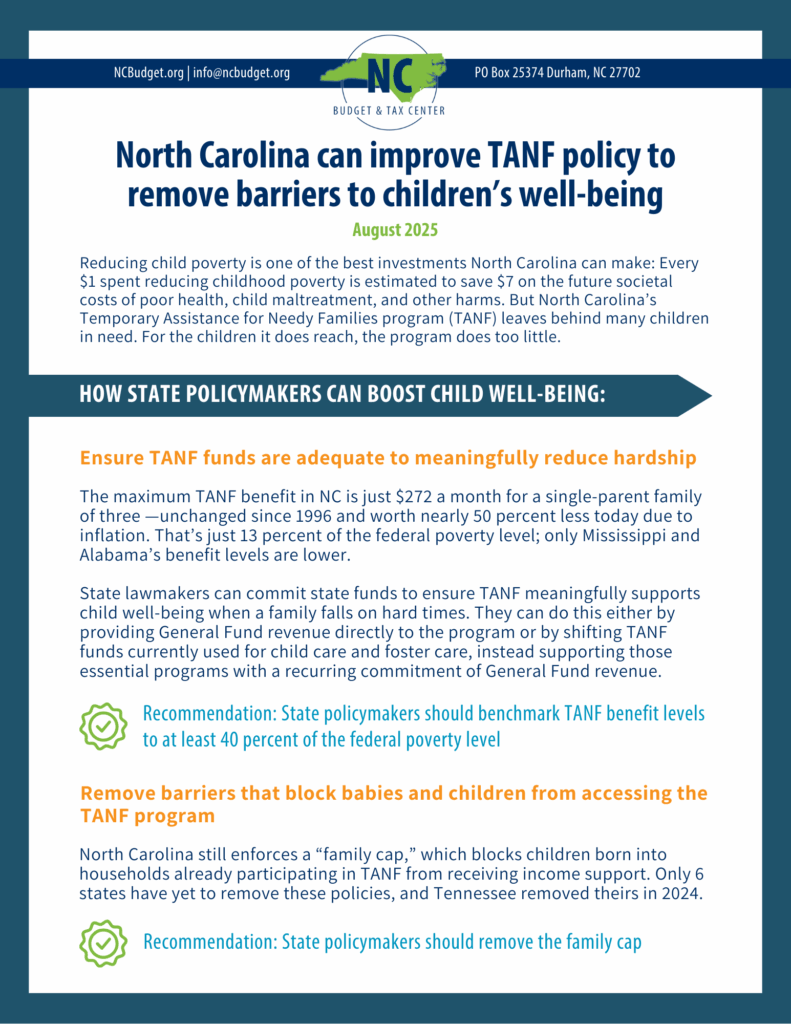

North Carolina can improve TANF policy to remove barriers to children’s well-being

Note: Learn more about how North Carolina can improve TANF policy to boost employment outcomes here Reducing child poverty is one of the best investments North Carolina can make: Every $1 spent reducing childhood poverty is estimated to save $7 on the future societal costs of poor health, child maltreatment, and other harms. But North…

North Carolina can improve TANF policy to boost employment outcomes

Note: Learn more about how North Carolina can improve TANF policy to remove barriers to children’s well-being here One goal of North Carolina’s Temporary Assistance for Needy Families program (TANF) is to help participants achieve sustaining employment. But current rules discourage people from increasing their earnings and assets, while relying on counterproductive punishment strategies that…

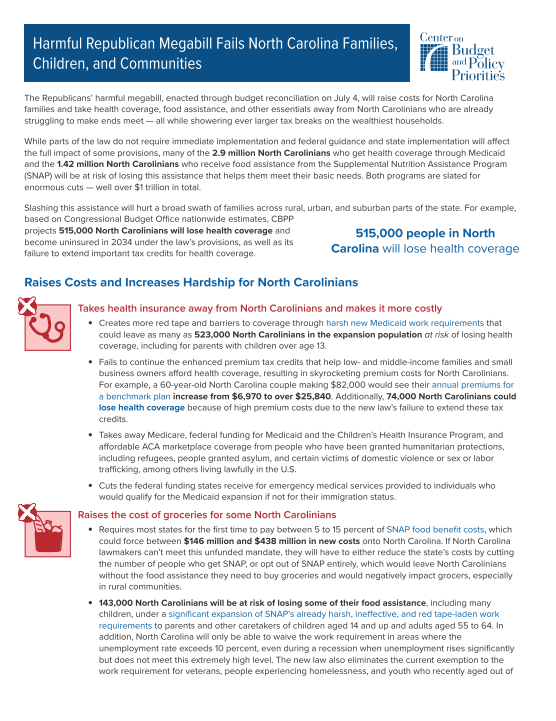

Fact Sheet: Harmful Republican Megabill Fails North Carolina Families, Children, and Communities

The Republicans’ harmful megabill, enacted through budget reconciliation on July 4, will raise costs for North Carolina families and take health coverage, food assistance, and other essentials away from North Carolinians who are already struggling to make ends meet – all while showering ever larger tax breaks on the wealthiest households. While parts of the…

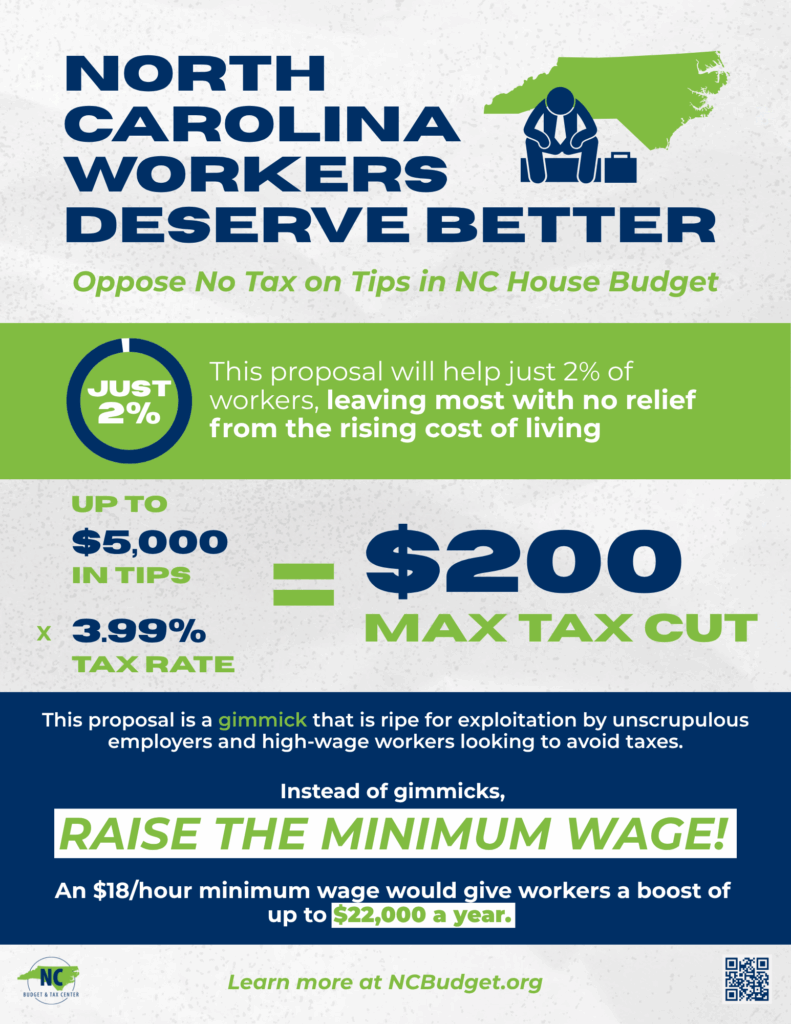

“No Tax on Tips” is a gimmick — raising the minimum wage is the real deal

Most of us — across race, place, and background — all want to live in a North Carolina where people who work for a living can support their families, keep food on the table, and build a more secure future. But instead of advancing policies that raise wages and expand the opportunity to thrive, some…