Refundable family tax credits would make NC’s tax system fairer

Across North Carolina, no matter where we live or what we look like, we want our families to be safe and healthy with a roof over our heads and food on the table. State tax credits for people and families with low and moderate incomes are a proven way to boost economic stability and advance equity. Over the last decade, leadership in the General Assembly has pushed through tax cuts that overwhelmingly benefit our state’s richest households, but policymakers who care about our communities should instead be looking to tax policies like state-level earned income tax credits (EITC) and child tax credits (CTC).

EITC and CTC would help people and families with the greatest need

The EITC is a fully refundable tax credit (more on that below) designed to reward work: For families with very low incomes, the credit initially grows with higher annual pay and then phases out at higher income levels. The chart below shows the average dollar amounts by income group that North Carolina taxpayers could receive from a modest state CTC and EITC in 2023.

These data are based on a state-level:

- CTC that provides a $250 annual credit per child to families with very low incomes and a $125 credit to families with low and moderate incomes. This updates the CTC that North Carolina had in place until it was repealed in 2017.

- EITC that provides eligible North Carolinians with a credit worth 20 percent of the federal EITC.

State tax credits can extend and complement federal credits

The federal-level EITC and CTC are powerful tools for reducing poverty, improving maternal and child health, and advancing racial equity. State credits complement these federal policies and deepen their impact.

North Carolina families with low incomes — especially those with young children — need a boost more than ever as child care costs continue to outpace inflation. The temporary expansion of the child tax credit that was put in place by the American Rescue Plan in 2021 led to a historic drop in child poverty across the country, but Congress failed to renew that expansion. A state EITC and CTC would bring some of those benefits back to North Carolina families.

These policies would benefit millions of the North Carolinians and especially our state’s kids. The state CTC could reach roughly two-thirds of North Carolina children, and the dollar amounts that families receive from this modest policy would make a meaningful difference for people with the lowest incomes. Based on our Living Income Standard, a $250 credit would provide almost 3 weeks of groceries for a single parent with a child.

Refundable credits would make our tax system more equitable

These policies would take steps toward addressing our state’s upside-down tax code, which currently allows the wealthiest taxpayers to pay the lowest share of their income in state and local taxes. Over 97 percent of the benefit provided by a state CTC — and over 99 of the benefit of a state EITC — would go to North Carolina taxpayers with incomes in the bottom 80 percent. In comparison, the full implementation of the income tax cuts that General Assembly leadership has put in motion would divert two-thirds of the cuts to the richest 20 percent of North Carolinians.

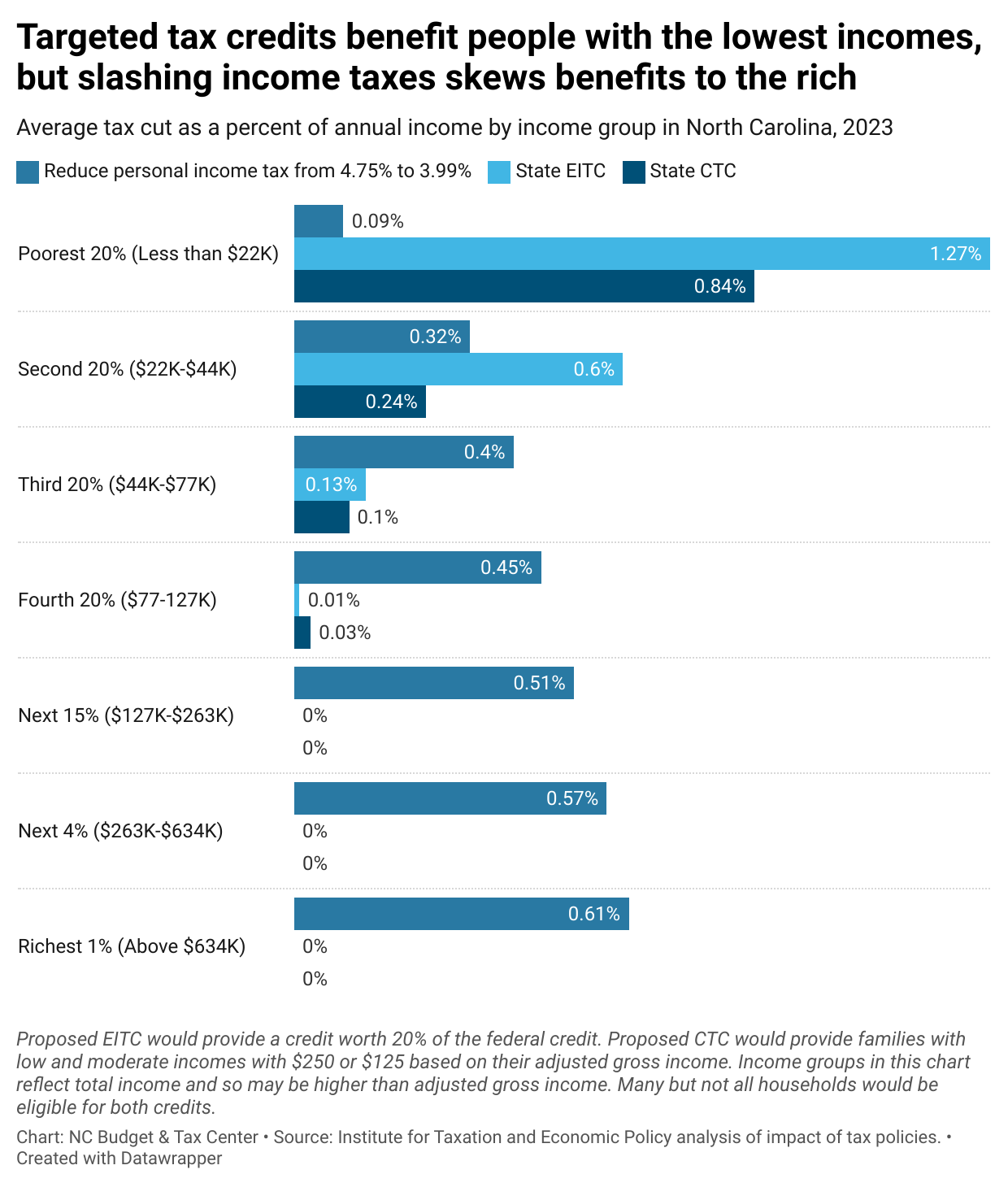

To fully realize their benefits, a state CTC and EITC would both need to be fully refundable. This means that if the credit amount is higher than what someone owes in taxes, they still would receive the full dollar amount. The chart below compares targeted refundable tax credits with the full income tax cuts scheduled to go into place by 2026. Cutting income tax rates from the current rate of 4.75% to 3.99% disproportionately benefits the very richest people in our state. The top 1 percent richest households would see a gain of 0.6% of their total income, while the poorest 20 percent would gain less than one-tenth of 1 percent of theirs. In comparison, and because they are fully refundable, a state EITC and CTC would both provide the greatest proportional support to the people who could use it the most.

The North Carolina House leadership understands that refundable credits are an effective way to get support — the budget bill they passed last week includes a refundable $2,000 credit for families that adopt a child. But the adoption credit would be available only to a tiny sliver of North Carolina’s families, and we need equitable tax policy for everyone.

We have used our state tax policy for good before: North Carolina established a state CTC in 1995 and added an EITC in 2007 to support families during the Great Recession. But over the last decade, the politicians in power have gotten rid of these proven policies and instead have allowed profitable corporations and the super-rich to rig our tax system in their favor. We can come together to insist on tax policies that advance economic equity and build the foundation necessary for every family and community in our state to thrive.