“No Tax on Tips” is a gimmick — raising the minimum wage is the real deal

Most of us — across race, place, and background — all want to live in a North Carolina where people who work for a living can support their families, keep food on the table, and build a more secure future. But instead of advancing policies that raise wages and expand the opportunity to thrive, some lawmakers are peddling gimmicks like the “No Tax on Tips” policy.

Versions of “No Tax on Tips,” first introduced by US Sen. Ted Cruz, have surfaced at every level of government, including in the NC House of Representatives. However, a look at a few key numbers reveals that “No Tax on Tips” would benefit only a small fraction of workers, give the biggest boost to higher earners, and do nothing to address the real challenges facing working families in North Carolina.

A tax break that leaves most behind

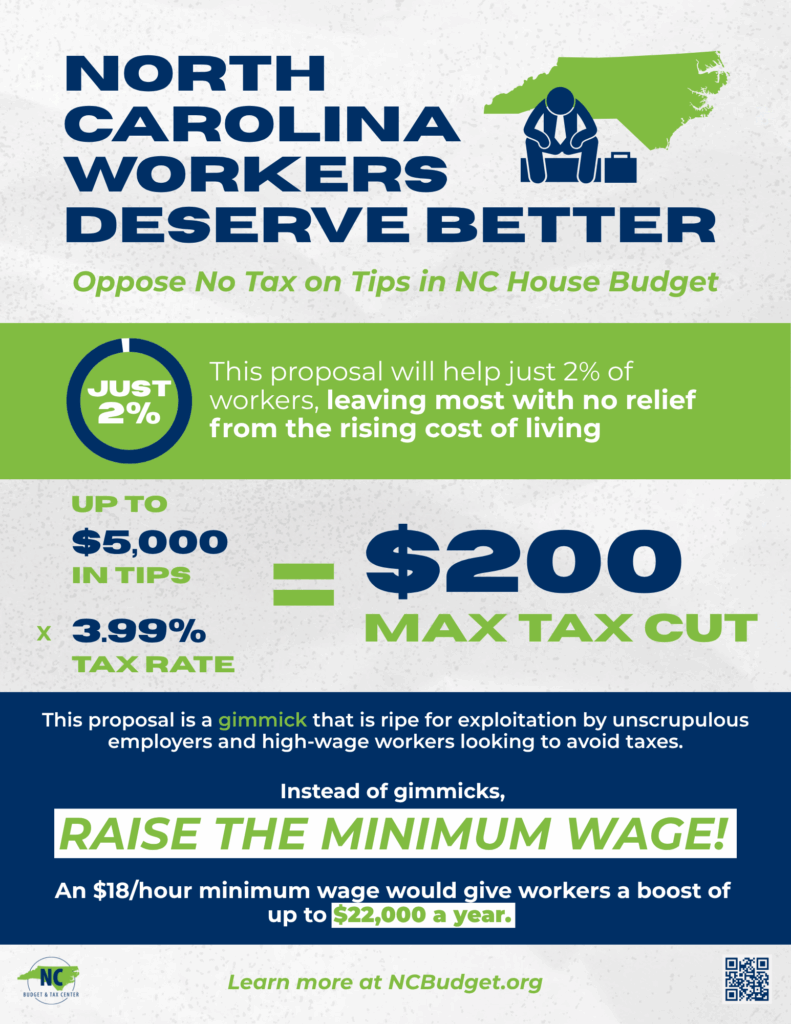

While North Carolina has an abundance of low-paid workers, the version of “No Tax on Tips” in the NC House budget would only reach about 2 percent of households in the state.

In the NC House budget version of the policy, most low-income workers would be left with no relief, and the maximum annual tax savings for tipped workers would be just under $200 and up to $5,000 in tips.

If lawmakers raise the state minimum wage to $18 an hour instead, many more low-income workers would see their earnings increase by as much as $22,000 annually. Furthermore, employers would be responsible for paying fair wages instead of taxpayers shouldering the cost.

Federal versions of this proposal aren’t any better.

Analysis from EPI shows that with “No Tax on Tips” under the federal budget, between 2.5 and 5.2 million tipped workers would receive an income tax deduction before the policy expires in 2028. Tipped workers would receive an average of $1,700 annually in tax cuts during the 4 years the bill would be in effect. However, the policy would disproportionately benefit the top 20 percent of all tipped workers, who would receive an average tax cut of over $5,700. Because so many tipped workers have incomes too low to have any federal income tax liability, the bottom 20 percent of all tipped workers would receive a cut of just $74 on average.

To make a real difference, Congress could raise the federal minimum wage to $17 an hour. This would reach almost 23 million workers, including 2.8 million tipped workers, who would earn higher wages with no expiration date. A full-time, year-round worker would get an average wage increase of $3,200 per year, with the largest gains going to the lowest-paid workers.

A dangerous distraction

In short, “No Tax on Tips” is not just a distraction from endless state and federal tax cuts for the wealthy – it’s a gimmick and a bad deal for low-paid workers. It reaches too few workers with too little benefit, and it can even lead to cases where workers lose eligibility for more impactful tax credits where they ultimately see their income go down. It undermines progress toward living wages, encourages employers to rely on more precarious and underpaid tipped work, and it opens the door to abuse by the wealthy who will try to game the system.

At its core, this policy allows the richest few and the most profitable corporations to dodge their responsibility to pay fair wages while shifting the costs to everyday people – and that’s no accident. It’s part of a larger strategy to divide us and block progress by offering symbolic gestures instead of real change.

North Carolinians deserve better

Lawmakers should stop playing political games with people’s livelihoods. If they truly want to support working families, they’ll raise the minimum wage, strengthen worker protections, and invest in the foundations of well-being for everyone — no exceptions.

We deserve a real raise — not a gimmick that leaves most of us behind.