NC Governor’s plan: A budget proposal that offers restrained hope

Last week, the Governor released his recommendations for the state’s two-year budget, kicking off this session’s budget season after the release of the updated revenue forecast in February. The updated forecast to last year’s predictions about how much money the state will collect in taxes, and therefore have to spend in the budget, showed that the state may collect $3.25 billion over the amount predicted last year. This development means more money is available than was expected last year. It means that there is more of an opportunity to address long-standing needs in North Carolina exacerbated by the failure to invest in the programs, services, and infrastructure that our growing state demands.

What it does not mean is that we have what we need.

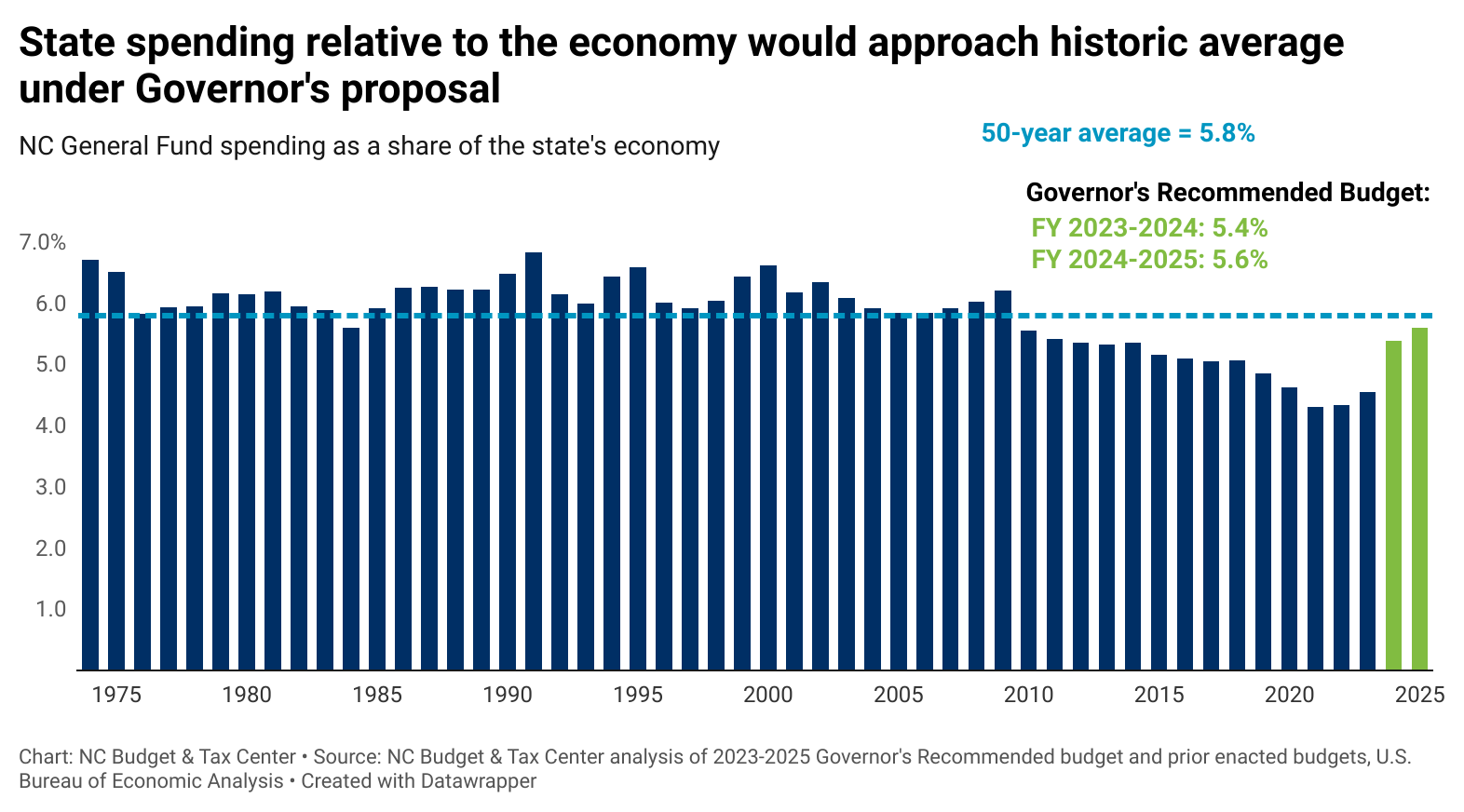

And yet, the response from legislative leaders is that the budget proposal spends too much when a review of the spending proposed falls well within, and even below, historic averages. The challenges we face are overwhelming, with the state’s backlog on infrastructure needs, challenges in public and mental health, failure to deliver a sound basic education, or fund the child care, job training, and transportation needed to remove barriers to work. The reality is that to move our state forward, our spending on public services will need to catch up and lay the foundation for a better, stronger future.

Governor Cooper’s proposal would increase spending after years of underinvestment, to $32.9 billion in fiscal year 2023-2024, which begins this coming July and ends in June 2024, and $34.2 billion in fiscal year 2024-2025. However, the second-year spending proposal (2024-2025) will be subject to changes next year during the “short” legislative session.

Notable priorities reflected in the proposal include halting tax cuts on individual income tax filers with higher incomes, stopping the elimination of the corporate income tax by keeping it at its current rate, expanding Medicaid as early as summer 2024, and fully funding the remedial plan in the long-standing Leandro legal case regarding funding for a sound, basic education for every child in North Carolina.

Increases spending to levels near the historic average

Compared to the 50-year average of 5.8 percent spending as a share of the economy (represented by the blue dashed line in the figure), the Governor’s proposal would put spending at 5.4 percent in the first year, or $2.5 billion below average spending in today’s dollars and in today’s economy. In the second year, the budget would put spending at 5.6 percent compared to the economy, which is $1 billion below the 50-year average in today’s dollars.

Compared to the budget enacted in last year’s “short” session, the Governor’s budget proposal comes in at 16 percent more spending, or $4.5 billion, after adjusting for inflation. This goes beyond the $3.25 billion in anticipated revenue over-collections from the updated February forecast, with the difference funded in part by the federal Medicaid expansion bonus and changes to how revenue is collected.

Reverses several legislative trends

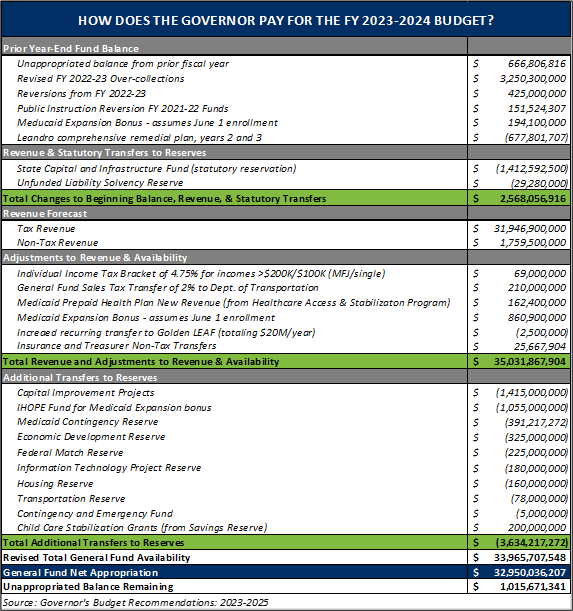

The Governor pays for the budget through a combination of key ways:

- Updating the current budget availability including through the better-than-previously-thought revenue collections last year;

- Slowing the tax cuts enacted in 2021, which would eliminate the corporate income tax and lower the already flat personal income tax rate for all incomes; and

- Adopting Medicaid expansion and beginning enrollment in summer 2024, thereby ensuring that North Carolina benefits from the federal incentive for expanding coverage.

In a shift from the legislative budget strategy in recent years, where the state’s Savings Reserve (also known as the “Rainy Day Fund”) ballooned at the expense of addressing current needs, the Governor proposed a transfer of funds required by statute to be sent to the “Unfunded Liability Solvency Reserve”. At the same time, the plan includes tapping into the overfunded Savings Reserve to help pay for supports needed for child care, specifically by ensuring child-care providers can access funds to provide services by increasing the base reimbursement rate.

Halts tax cuts for corporations and for those earning high incomes

The Governor’s proposal to stop some of the income tax cuts included in the 2021 budget, which he signed into law, will be transformational for North Carolina for years to come. The plan would hold the corporate income tax rate at 2.5 percent, rather than a decline to zero by 2030 as the state is currently scheduled to do under the last two-year state budget enacted in 2021.

The personal income tax rate reduction will also be slowed in the Governor’s plan. In addition, the plan creates two levels for the personal income tax, once again creating a “graduated” income tax structure after the round of tax cuts enacted in 2018. This “graduated” tax structure will mean that different tax rates apply to people in different income brackets, so that those with higher incomes pay a greater share of their income in taxes. In the Governor’s plan, those with incomes above $200,000 who file joint income taxes or above $100,000 for those who file as single, will pay a higher tax rate of 4.75 percent for all future years. However, North Carolinians with incomes below those income thresholds will see their income tax rate decline to 4.6 percent in 2024 and 4.5 percent in 2025, the two years budgeted in this plan, and will continue to decrease until it reaches 3.99 percent in 2027, after which it will remain at that rate.

The Governor’s budget makes additional revenue changes to comply with a statutory change made last year and to revise it in future years. Namely, the budget proposal includes a transfer of 2 percent of sales tax revenues from the General Fund to the Highway Fund and Highway Trust Fund in the first year of the biennium, and proposes maintaining the transfer of 2 percent rather than increasing it, which it is slated to do per the last state budget enacted.

Looking ahead: Leverage the state budget to advance equity, inclusion, transparency, and democracy

With this first major milestone in the budget process complete, it’s now up to the legislative chambers (House and Senate) to release their respective proposals and come to agreement on a two-year budget that will meet the needs of a growing North Carolina.

As a moral document, the state budget has the potential to meet the needs of everyone in the state, raising the quality of life and standard of living while also meeting the needs of those in underserved communities and with oppressed identities.

Let’s hope this year will turn over a new leaf for North Carolina, where lawmakers choose to provide for the people that elected them to office, rather than continue the status quo by holding the interests of the wealthy few and corporations above everyday North Carolinians.