Latest news on what’s going on with the NC budget

until we lose another billion dollars of our public funds to tax cuts for corporations and the wealthy.

Instead of giving away $1 billion in tax cuts next year to the wealthy few, lawmakers should stop the income tax cuts, hold our already-low tax rates where they are, and immediately make life more affordable us all.

11:30 am, Friday, Dec. 19

In our first budget update this year, we told you we were looking for three things during the 2025 Long Session:

- A more transparent budget process.

- A spending plan focused on the things regular North Carolinians say they need to live well, like accessible health care, strong public schools, and a lower cost of living.

- Tax policy that makes corporations and the rich pay what they owe, instead of continued tax cuts for the wealthy few that cost our state billions each year.

Sadly, NC’s legislative leaders were not working for regular North Carolinians this session.

People from across the state showed up in Raleigh to demand support for a child-care system in crisis, funding to prevent painful cuts to Medicaid, and raises for teachers so that NC doesn’t continue to lose educators to states that pay a professional salary.

Unfortunately, legislative leaders didn’t bother to show up and pass a comprehensive state budget. They didn’t bother to provide enough Medicaid funding to last the whole fiscal year, leaving the program on track to run out of money early next year. And they didn’t bother to make a plan to protect their constituents from cuts in the harmful federal megabill passed in July — the so-called “One Big Beautiful Bill,” — which will cause half a million North Carolinians to lose health coverage over the next several years.

It’s notable what legislative leaders did make time for:

- Passing new voting maps that increase their power and further insulate them from accountability to their voters.

- Overriding the governor’s veto of a bill that drives up energy costs and lets utilities like Duke Energy shift more costs onto customers.

- Opting into a federal program that helps fund private school vouchers, which is expected to mostly benefit high-income taxpayers while costing the federal government billions that could have been used to support public schools. (This action was vetoed by the governor and has not yet been overridden.)

Instead of focusing on accumulating power and working on behalf of corporate and national interests, state lawmakers ought to have been focused on reducing the cost of living right here in NC — the number one priority of their constituents.

Unfortunately, scheduled tax cuts for corporations and the ultra-rich are projected to lead to a $3.5 billion budget shortfall in the coming years, preventing lawmakers from making the affordability investments NC needs. Leaders in the NC House made a measured proposal to slow future tax cuts and prevent the worst of the damage, but leadership in the NC Senate is recklessly charging full steam ahead. Both chambers remain committed to the next round of cuts on Jan. 1, which will leave the state with $1 billion less in public dollars that could have been used to address the high cost of housing, health care child care, and so much more.

It’s time for our state leaders to recognize that these tax cuts undermine the well-being of our people and our economy, and to choose a path that prioritizes shared prosperity — so families and communities across our state can grow and thrive together.

Learn more:

- Check out this slide deck summarizing the 2025 Long Session and where legislative leaders fell short.

4:30 pm, Thursday, Dec. 11

Back in October, the NC Department of Health and Human Services (DHHS) was forced to enact Medicaid cuts due to insufficient funding from the NC General Assembly (NCGA).

Yesterday, Governor Stein announced that he would reverse those cuts in the face of legal challenges. While this reversal will provide temporary relief to health care providers and North Carolinians trying to access services, the program will run out of money in just a few months unless state lawmakers take action.

Legislative leaders agree that more funding is needed, but they have so far failed to pass a bill to do so. The NCGA will be back in session on Monday according to their calendar, and they need to fully fund Medicaid now.

Even as North Carolinians suffer from not knowing if health care will be there for them when they need it in the spring — and federal Medicaid cuts from the so-called “One Big Beautiful Bill” are beginning to take effect — the NC House and NC Senate are charging full steam ahead with yet another round of state tax cuts for corporations and the wealthy few. Those cuts go into effect on Jan. 1, 2026, and will cost NC $1 billion next year that could have gone to people’s health care, teacher pay, child care, and lowering the cost of living.

Here’s what you can do:

- Learn about everything we could fund if, instead of losing $1 billion to tax cuts, we spent it on affordability priorities.

- Share our statement connecting the pause to tax cuts and the immediate priority for funding Medicaid

- Tell lawmakers what you would fund in your community using #LoveNCFundNC on social media

4 pm, Wednesday, Oct. 1

In our last update, we explained that because state lawmakers underfunded Medicaid in their July stop-gap spending bill, the NC Department of Health and Human Services (DHHS) announced plans for Medicaid cuts.

Today, those cuts go into effect — all because the NC House and NC Senate were unable to agree on a targeted bill to cover the shortfall when they were back in Raleigh last week.

The exact impacts of these cuts are still coming into focus, but health-care providers who are paid directly by the state (and who serve populations like foster youth, people with significant medical needs, and those with severe mental illness and substance use disorders) will likely be impacted first.

Legislators also, of course, have still been unable to pass a comprehensive state budget that would address many urgent needs beyond Medicaid funding. (Why the stalemate? Senate leadership insists on maintaining reckless personal income tax cuts that provide huge benefits to the richest 1 percent, while doing little to nothing for regular people and starving the state of money needed to pay teachers, reduce the cost of living, and provide basic services like a functional DMV ...)

At the same time, Congress failed to pass a federal funding bill by the Oct. 1 start of the new fiscal year, triggering a partial government shutdown today. The disagreement is over funding health care. Republicans are committed to 1) Allowing ACA tax credits to expire, resulting in huge premium increases for regular people, and 2) Allowing Medicaid cuts from H.R.1 to go into effect, causing folks to become uninsured. Meanwhile Democrats are demanding: 1) The extension of ACA tax credits to keep health care premium costs down, and 2) The reversal of Medicaid cuts in H.R.1 so that folks can remain insured. Democrats are also pushing for binding language that prevents the Trump Administration from unilaterally or illegally undoing bipartisan funding laws.

We’ll be tracking impacts of the shutdown on our state budget and people’s well-being.

Here’s what you can do:

- You can always find the latest high-impact action on our website here. Right now, we need to keep the pressure on NC Senate leadership especially to pause scheduled tax cuts for the rich, and on both the NC Senate and NC House to keep the corporate income tax.

- Let us know how we’re doing! Be on the lookout for a survey about these real-time updates next week. With the NCGA not scheduled to come back until 10/20 and no state budget in sight, our updates may be less frequent for the rest of this year.

2:30 pm, Tuesday, Aug. 19

A couple weeks ago, we updated you on the NC General Assembly’s (NCGA) inadequate, stop-gap spending bill. Now we’re seeing an immediate consequence of the legislature’s failure to fund our needs: state-level Medicaid cuts.

Here’s what happened: In July, the NC Department of Health and Human Services (DHHS) told the NCGA that the state budget would need to provide $819 million next year to maintain current Medicaid services and payments to health care providers. The NCGA’s stop-gap spending bill then proceeded to underfund DHHS’s request by $319 million — even as state lawmakers charge ahead with tax cuts for the rich that will cost over $450 million in the next fiscal year alone.

Then last week, DHHS communicated the cuts that would be implemented to address the funding shortfall: “rate reductions of 3% across all providers, as well as rate reductions of 8% or 10% for select providers, and elimination of certain services altogether — all with an effective date of October 1, 2025.” That means providers will get less money for providing the same services, and some may decide that they can’t afford to accept Medicaid.

As we know, these state cuts are on top of the federal Medicaid cuts passed into law last month in the Republican Megabill — one of the latest estimates of that law’s impact is that more than half a million North Carolinians will lose health coverage by 2034.

Our state lawmakers still have time to act by passing a comprehensive state budget that fully funds DHHS’s Medicaid request and protects our state from federal threats to our health. North Carolina is a prosperous state that can afford to fund the foundations of well-being for all — let's equip ourselves with the facts and not let anyone tell us otherwise.

2:30 pm, Wednesday, July 30

Today, state lawmakers passed a bill to fund minimal, time-sensitive needs. This includes enrollment growth in public schools and community colleges as well as scheduled step increases in salaries for teachers and state employees.

But there’s still no comprehensive state budget in sight, and no plan from lawmakers about how they will protect NC from the health care and food assistance cuts that Congress has passed into law. That harmful Republican megabill:

- Costs NC $40 billion in Medicaid funding over 10 years, potentially triggering the end of Medicaid expansion under state law

- Shifts $420 million per year in SNAP (food assistance) costs onto the state, and $65 million per year onto counties

- Takes food assistance and health care (both Medicaid and Medicare) away from most groups of lawfully residing immigrants

- Could cause up to 142,000 North Carolinians to lose food assistance and up to 255,000 to lose Medicaid based on new work-reporting requirements alone

State budget writers can respond to this federal cost shift without cutting state-funded programs by stopping scheduled tax cuts for corporations and the richest North Carolinians next year — they're already getting plenty at the federal level. Legislative leaders could put that preserved revenue toward a plan to protect our residents from losing their health care and access to food.

But to make this happen, many North Carolinians will have to speak up and demand a state budget that puts our well-being ahead of corporate profits. (And that puts our well-being ahead of state tax cuts for the rich that are equal to a brand new Porsche SUV for every North Carolina millionaire each year...😒)

Here’s what you can do:

- Take action: Tell your state lawmakers to pause tax cuts for corporations and the wealthy to protect health care and food assistance for the people of NC.

- Learn more: Check out this slide deck that provides a helpful summary of how the harmful Republican megabill will hurt North Carolinians.

4 pm, Tuesday, July 1

Today is the first day in NC’s new fiscal year, but state lawmakers have left Raleigh with no budget and no plan to safeguard people’s well-being from harmful federal cuts to Medicaid, food assistance, and other vital programs.

Here’s what you need to know ...

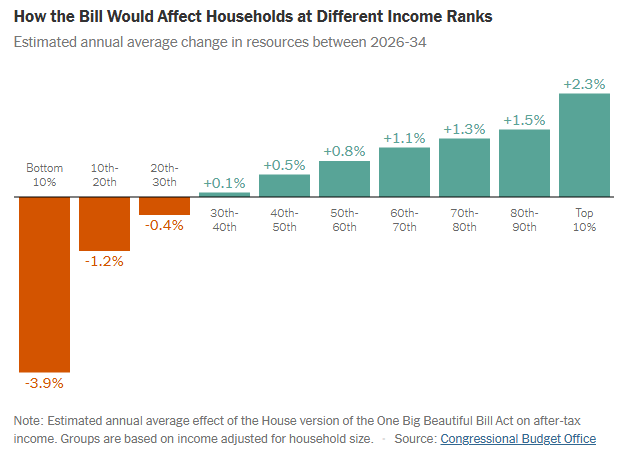

1. The US Senate just advanced a plan to take from the poorest to give to the richest. This means that North Carolinians will lose health insurance and food benefits so that millionaires can get another tax cut unless the US House stops it.

Chart Source: New York Times

2. State lawmakers have the power to protect scarce state revenue and stand up for North Carolinians’ health and well-being. But instead, the NC Senate majority wants to add new tax cuts for the rich. Their plan would give an additional average annual tax cut of $64,700 to millionaires in North Carolina, on top of their federal tax cuts and current scheduled tax cuts after more than a decade of state cuts.

3. Meanwhile, the NC House wants to take a more responsible step to slow down scheduled personal income tax cuts. But their tax plan still fails to protect money that NC will need to lessen the harm of federal cuts: the NC House plan maintains the eventual elimination of the corporate income tax and allows tax cuts that mostly benefit the wealthy to continue next year.

4. Lawmakers have left Raleigh without a final state budget. When they come back, they need to hear from us: 1) pause scheduled state tax cuts so NC has enough money to fill federal gaps and protect health insurance and food assistance, and 2) make sure corporations and the wealthy pay what they owe in state taxes so that NC has what it needs to thrive.

...and here’s how you can help!

- The next days are our last chance to impact the federal budget debate. Reach out to key members of Congress and urge them to vote no!

- Reach out to key state budget writers and tell them to stop the tax cuts! Our toolkit will help.

- Tell 3 friends to reach out, too!

- Learn more about how NC millionaires are getting richer from state and federal tax cuts, and how NC can establish a millionaire’s tax

4 pm, Wednesday, June 18

Yesterday, North Carolinians gathered at the offices of our US Senators to urge them to stop planned cuts to health care and food assistance that are moving forward in the Congressional reconciliation process this month.

We join everyday North Carolinians who are standing up to voice their opposition to these plans, because we know that federal decisions matter for people’s well-being and will impact our state budget in important ways.

Here are just a few of the proposed federal cuts that would generate big costs for North Carolina:

- Reduced federal commitment to sharing in the cost of services that mean North Carolina could have to pay $584 million more each year to help cover food benefits

- Less support for the administration of federal-state programs, including cutting support for SNAP administration in half, meaning NC would pay $68 million more each year to run the SNAP program

- Cuts to Medicaid funding that would cost an average of $860 million per year if NC continues to provide coverage to everyone who is eligible — or could trigger a repeal of Medicaid Expansion altogether

North Carolina state budget

When state budget writers are faced with federal cuts, they have limited options: They can cut services even more, cut programs in other areas of the budget, or raise revenue.

As Congress works to finalize their plans to finance tax cuts for the ultra-wealthy by taking away food assistance, health care, student loans and grants for higher education, and more, the most responsible action that state budget writers can take is to stop scheduled income tax cuts.

In the coming weeks, a key group of lawmakers (the “conference committee”) will be working toward a final state budget and making decisions that impact how much revenue we’ll have to spend. Their plan must consider these new federal costs, and they must tell North Carolinians how they will address them.

This is a crucial time to call key budget writers and ask them to stop scheduled tax cuts. Making sure the wealthy and profitable corporations pay what they owe would go some way to providing the care that Congress has been so willing to take away. Here’s what you can do:

- Read and share recent information:

- Take action: Demand the NCGA Pause Tax Cuts for the Wealthy and Corporations!

1:30 pm, Tuesday, May 20

The NC House just released their full budget proposal yesterday evening. Here’s what we know so far:

- Rightly rejects some of the most extreme tax measures from the Senate’s budget: The House revises the revenue thresholds under current law that trigger future reductions in the personal income tax rate. This means that the personal income tax rate would decrease more gradually than in the Senate’s budget, offering some minimal protection from looming federal cuts.

- Maintains the elimination of the corporate income tax: The House makes no change to the corporate income tax (CIT). Under current law, the CIT rate will continue to decline over the next several years before being eliminated in 2030, costing our state $2 billion in lost annual revenue. At a time of rising costs, heightened uncertainty about federal cuts and the national economy, and an ongoing lack of affordable child care and housing for the NC workers who fuel our economy, more tax cuts for corporations is unacceptable.

- Charges ahead with income tax cuts for the wealthy few, and tax gimmicks for the rest of us: Like the Senate, the House charges ahead with a personal income tax rate reduction next year that delivers the biggest benefit to the wealthy few, and almost nothing in tax breaks for those struggling the most. A gimmicky proposal to exempt a portion of tips from taxation provides little financial boost to struggling North Carolinians compared to targeted tax credits for low-income workers, and is ripe for abuse by employers and high-earners.

- Like the Senate, proposes record-low state spending as a share of our economy. To pay for endless tax cuts for corporations and the rich, the House proposes a tuition hike for college students, enacts sweeping cuts across state government, and continues to neglect chronically underfunded priorities like K-12 education, housing, and child care.

With voting expected later this week, you still have time to let your state representatives know how you feel about this budget proposal. Here’s what you can do:

3:30 pm, Friday, May 16

Earlier this week, US House Republicans advanced federal legislation for the largest cuts to Medicaid and SNAP in the programs’ history. These proposals threaten both the well-being and wallets of North Carolinians.

Then just breaking this afternoon, the plan failed to gain approval in a key House committee for the budget because some House Republicans wanted even steeper cuts to Medicaid including harsher work requirements. While this could delay passage, if these leaders gain support there will be more harm to people across North Carolina.

To be clear, the harsh and ineffective new work requirements in the proposal put forward mean that in North Carolina:

- Up to 496,000 people could lose access to health care

- 375,000 people live in households at risk of losing food assistance

Slashing crucial and popular programs to pay for federal tax cuts that benefit corporations and the ultra-rich is the goal for these lawmakers. We must be clear with our federal delegation — and particularly Senators Tillis and Budd — that the US House’s proposed plan to take away health care and food assistance from North Carolinians to fund tax cuts for the richest 1 percent is unacceptable. These federal proposals are moving through the budget reconciliation process, which means they’ll require complete agreement between the US House and Senate members to move forward.

North Carolina state budget

It’s past time for our state legislators to get serious about stopping the tax cuts and passing a budget that prepares NC for the consequences of the federal funding and staffing cuts to programs and services that help our communities.

Here in NC, the state House has begun releasing portions of its budget proposal, and we’re busy reviewing them. We anticipate their full state budget proposal will be released on Monday. We will continue to keep you informed on what’s at stake and release our analysis as soon as possible.

Here’s how you can take action in the meantime:

- Read our analysis of how federal cuts to SNAP and Medicaid will hurt North Carolinians and cost our state.

- Sign-on letter at ncbudget.org/federalletter

- Contact the federal delegation at ncbudget.org/peoplefirst

1:30 pm, Thursday, April 16

Last night, the NC Senate voted 31-16 to approve their budget proposal. The proposal offers “raises” to teachers and state employees that are less than the rate of inflation. It enacts cuts to our community college system and eliminates the Office for Historically Underutilized Businesses. It proposes a record-breaking low level of total state spending, relative to the size of NC’s economy.

And it does all this to pay for tax cuts for corporations and the wealthiest North Carolinians, even going so far as to schedule the personal income tax rate to decrease to 1.99 percent as soon as 2031, costing our state billions in annual lost revenue that is sorely needed in our communities. Next year, the Senate plan would deliver a $3,650 tax cut to those making over $774,000 — and $5 to the worst-paid North Carolinians.

We know that this budget proposal doesn’t align with North Carolinians’ priorities. When some Senators tried to offer amendments to (for example) keep the corporate income tax at its current rate to fund policies like Paid Family Leave, they were blocked by the majority party with maneuvers that allowed senators to avoid voting directly on the amendments and being held accountable for those votes

With a Senate proposal this deferential to the wealthy and transparently out-of-touch with everyday North Carolinians, we have to make sure the House is more attuned to constituent priorities and fiscal responsibility.

Here’s what you can do:

- See how your state senator voted on this bad budget plan

- Tell your lawmakers to pause tax cuts for corporations and the wealthy few

- Read our blog on the details of the Senate’s budget proposal; knowledge is power!

- Spread the word on social media and in your networks – it's time to get loud!

7 pm, Monday, April 14

With the release of their budget proposal today, the Senate has made their priorities clear. Reckless tax cuts for corporations and the wealthy will go ahead as planned — and deepen and accelerate — even as North Carolinians’ demands for more funding for child care, K-12, and more go unmet.

Here’s what you need to know:

- Due to scheduled tax cuts, NC’s revenue is expected to decline year-over-year this biennium, leading to recurring budget deficits that will grow over time.

- Recurring deficits are expected if NC’s economy remains steady. In the worst of circumstances, federal tariff policy will push the economy toward recession AND Congress will dump costs for Medicaid and food assistance onto state government, worsening both the revenue and spending side of our state budget equation.

- Governor Stein responded to this information responsibly and called for a pause on scheduled tax cuts in his budget proposal. The Senate, meanwhile, wants to charge full steam ahead with tax cuts for corporations and the wealthy few, regardless of the consequences for everyday North Carolinians.

- The Senate failed their own “revenue threshold” test for triggering additional personal income tax cuts in 2028. But instead of respecting their own rules for fiscal responsibility, their budget proposal just eliminates the threshold requirement entirely for that year.

This isn’t the end of the road. The Senate will vote later this week and we need to make sure they hear from us:

- Tell your lawmakers to pause tax cuts for corporations and the wealthy few.

- Read our full statement on the Senate’s budget.

Thursday, April 10

The 2025 legislative session is in full swing.

Legislators’ priorities have been sent to the bill drafting division to be written out in legislative language and given bill numbers, and the deadline to file those bills has passed. The real study and negotiation of the session begins. All bills will go through the committee process, and those that make it through will be voted on.

Some of these bills have the potential to fund a better future, and some would make people’s lives easier today. Some advance an important goal for NC but fall short in their design, while others would block progress for people and communities. You can read our complete summary here, where you’ll also find links to each bill and a legislative brief with additional details.

- Join us: Legislators have put their ideas into bills; now it’s time to make our voices heard in Raleigh. We hope you’ll join us for the Our Dollars Our Future day of advocacy this Tuesday 4/15. RSVP here!

1:30 pm, Wednesday, March 19

Today, Governor Stein released his proposed state budget for the next two fiscal years. It’s great news for our communities’ well-being, but now we need your help to keep up the momentum.

The recommended budget is basically a suggestion from the Governor to the legislature, based on requests that he’s received from state agencies and other priorities. It will be up to the NC House and the NC Senate to accept or reject these suggestions as they put together their own budget proposals in April and May.

Years of state tax cuts have enriched corporations and the wealthy few in NC while ignoring community needs, creating artificial scarcity across our state. The Governor's recommended budget proves we have the resources to better fund community priorities when corporations and the rich pay what they owe in taxes.

Here are some takeaways from the recommended budget:

- It would move our tax code in a more equitable and adequate direction by pausing scheduled cuts in corporate and personal income tax rates, instead funding a Working Families Tax Credit (WFTC), a state child tax credit (CTC), and a child and dependent care tax credit (CDCTC).

- It would make progress on needs that have been neglected for too long, like raising teacher pay, hiring enough DMV workers, and modernizing our elections infrastructure.

- It puts people’s well-being over special, wealthy interests by investing in child care instead of spending our public money on millionaires’ private school tuition costs and shady reserve funds.

- It’s a very good start; we know that policies such as an even more generous Child Tax Credit could make child poverty a thing of the past in North Carolina.

This recommended budget is very good news. But to keep up the momentum, lawmakers need to hear from you (and all of your friends!): Tell your state lawmaker to pause tax cuts for corporations and the wealthy few

- Check back on Friday for more detailed analysis of what’s in the Governor’s recommended budget!

Noon, Tuesday, Feb. 25

Today, lawmakers will vote on HB47, a bill that authorizes spending only an additional $500 million for Helene recovery.

The $1.3 billion appropriated to date for Helene recovery covers less than 3 percent of the total damage estimate. And the additional $500 million in HB47 is less than half of the approximately $1 billion that the Governor requested for this next round of Helene recovery funding.

As BTC Public Policy Analyst Alex Campbell has written, HB47 does little to correct the misaligned priorities between state lawmakers and what impacted Western North Carolinians say they need:

"Although the bill does provide a much-needed $10 million for rental assistance, it still does not include any money for small business grants, for mental health services, for community care stations, for rebuilding in Eastern North Carolina, or for oversight of private firms and non-profit organizations operating in the area, such as insurance and utility companies.” (Full blog post here)

- Learn more

- Take Action: Have you been impacted by Hurricane Helene? Tell NC lawmakers what you need to recover.

4:30 pm, Friday, Feb. 14

North Carolina’s Consensus Revenue Forecast was released this afternoon. This forecast is what tells lawmakers (and all of us!) how much public money they have to work with when they craft our state budget this year.

You can see our full statement at this link. Here are a few takeaways you can share with friends:

- The available revenue (aka public money from our tax dollars) is going to be flat next year — this means that, unless something changes, long-neglected needs will continue to go unmet.

- The following year, available revenue is actually expected to decline. In the context of continued inflation and population growth, not to mention possible federal cost shifts onto our state, this is bad news for our communities.

- It doesn’t have to be this way. The forecast tells us that the decline is NOT due to a weak economy, but instead is due to previously scheduled tax cuts for corporations and the super wealthy. Lawmakers can change course at any time, and they should.

2 pm, Friday, Feb. 14

Lawmakers will put together a full budget bill later in the session, but this week HB47 has been advancing through House committees — a bill that authorizes spending only an additional $500 million for Helene recovery. Here’s what you need to know:

- HB47 moved through the House Appropriations Committee this week, on its way to a likely floor vote next week.

- The $500 million is less than 1 percent of total damages from Helene ($60 billion).

- The $500 million is also less than half of the approx. $1 billion that the Governor requested for this next round of Helene recovery funding.

- HB47 continues to deny small businesses in Western NC the grant funding they are asking for to recover — even as lawmakers charge full steam ahead with eliminating income taxes for massive corporations in our state.

Our lawmakers can afford the full and equitable recovery that Western NC deserves by pausing scheduled income tax cuts for the rich and making corporations pay what they owe in taxes.

Have you been impacted by Hurricane Helene? Tell NC lawmakers what you need to recover

5 pm, Friday, Feb. 7

NC’s Savings Reserve Fund (aka Rainy Day Fund) will be a big topic of conversation in this year’s budget process. The state just released its gold-standard estimate of how much of our public money we should keep in the fund. Here’s what you need to know:

- NC is already meeting the target. The target balance shakes out to about $3.77 billion, and the Savings Reserve currently sits at $3.83 billion. Despite already meeting the target, we may hear from budget leaders that they want to add even more due to Helene recovery.

- Exceeding the target would replace a reasonable goal with an unachievable one. Annual General Fund spending is about $32 billion and Helene damage is about $60 billion; there is no way for NC to save at this scale, which is why reliable federal funds and state commitments of General Fund revenue are crucial.

- If lawmakers are concerned about having enough public money to meet needs, they need to focus on reliable revenue, not fanciful amounts of reserves. Lawmakers can and should create stability for families and small businesses — those impacted by Helene AND those suffering from under-investment for years across the state — by pausing scheduled income tax cuts.

In a time of likely federal cost shifts to states and other budget pressures, eliminating the corporate income tax and continuing to slash the personal income tax rate will only enrich corporations and the super wealthy while creating artificial scarcity for the rest of us. This budget cycle, let’s show off our knowledge about the Rainy Day Fund, and tell lawmakers to starting spending our tax dollars on our needs.

Take Action: Tell our leaders: Put us first, not millionaires and billionaires

Want to receive a text with updates this session? Sign up here!

11 am, Wednesday, Jan. 29

After a ceremonial start to the session earlier this month, the House and Senate will reconvene in Raleigh at noon today. Their focus will be on crafting a two-year budget during this long session. At 2 pm, the House Select Committee on Helene Recovery will meet.

This year, we're on the lookout for:

- A more transparent budget process

- A spending plan focused on OUR well-being, like child-care, public ed, and a full and equitable recovery for Western NC

- Tax policy that makes corporations and the rich pay what they owe, by keeping the corporate income tax (under current law, it will be eliminated in 2030 😡)

Recent news of a federal funding freeze has further raised the stakes for the budget process this year. While the memo has since been rescinded, it makes clear what’s at stake. If federal funding is no longer provided, NC will either need to make cuts to the quality or reach of current services, or find new revenue to fill the gap.

NC lawmakers have already scheduled income tax cuts far into the future. Policymakers must pause these cuts until greater certainty is provided by the federal government as to their intended actions.

Want to receive a text with updates this session? Sign up here!

More reading

4 pm, Friday, Jan. 24

NC lawmakers are returning on Wed., Jan 29, to Raleigh to begin legislative work.

Need a refresher on what’s at stake this budget cycle?

In these next months, lawmakers could choose to make huge corporations pay what they owe in taxes by keeping our modest state corporate income tax (CIT) intact — or they could continue with plans to fully eliminate the CIT by the year 2030. Eliminating the CIT will line the pockets of wealthy out-of-state shareholders while NC’s public school teachers go without adequate pay, parents go without affordable childcare, and Western NC goes without a complete and inclusive recovery from Helene.