NCGA ignores fiscal realities and fails to roll back tax cuts

Earlier this week, the Governor signed a flawed state budget that continues North Carolina down its path toward the elimination of its corporate income tax and more cuts in personal income taxes. That means more dollars will stay in the pockets of North Carolina’s wealthy elite and corporations. The General Assembly passed the budget in what might be record-setting time, introducing the bill as a conference budget and allowing for appallingly little transparency and input.

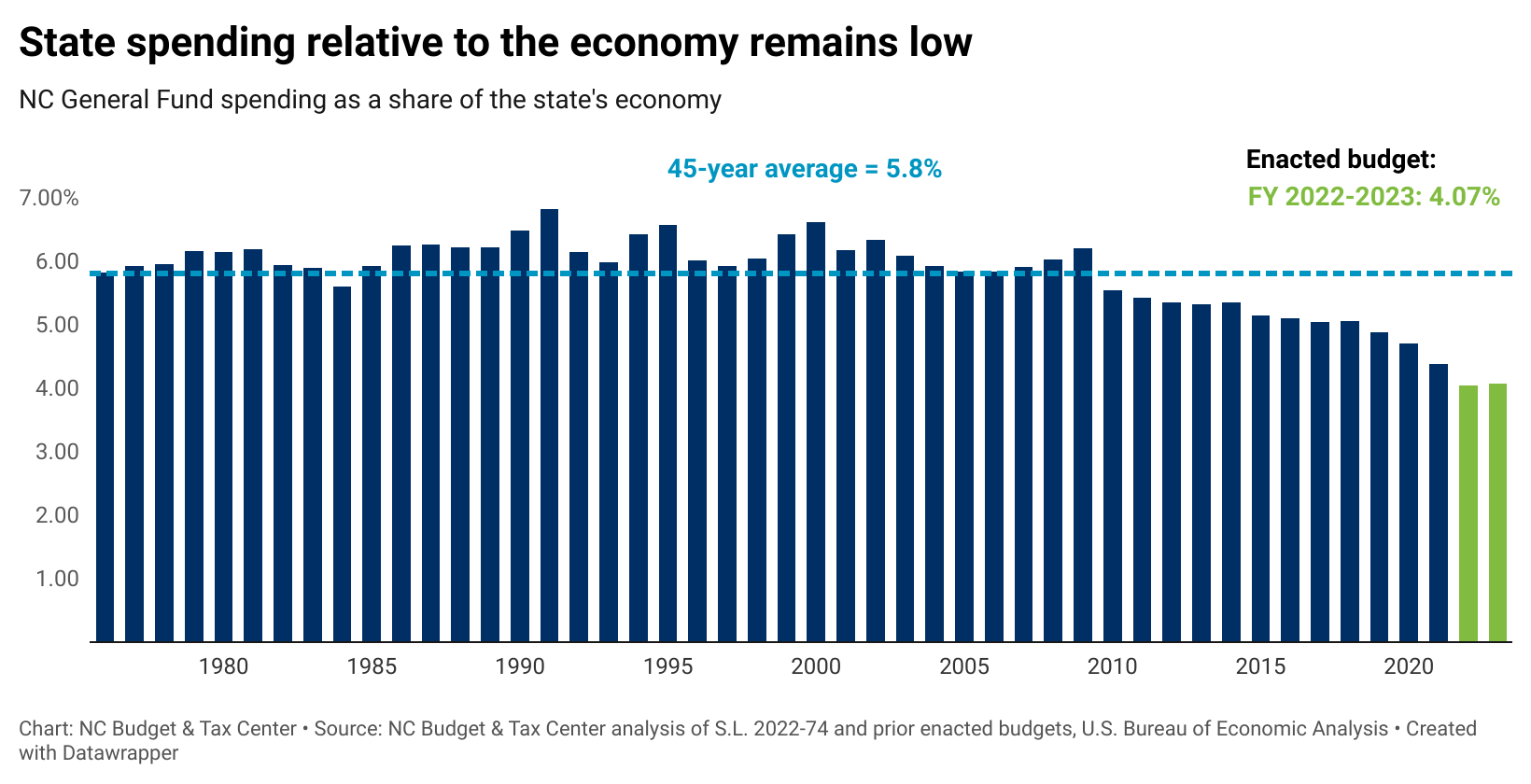

This enacted budget brings North Carolina to a new low in spending as a share of the economy and to new depths for transparency and democracy.

With revised revenue over-collections of nearly $2 billion for the new fiscal year and additional federal dollars for necessary infrastructure investments, lawmakers actually had funds available to allocate toward communities across the state. Given the reality that individuals and families are experiencing difficulty making ends meet, which was the case even before the recent rise of inflation that has put basic needs out of reach, lawmakers had choices available that could have alleviated some needs, including food insecurity and rent hardship.

Instead, leaders in the General Assembly continue to march our state down the spiraling path in both taxes and investments — two sides of the same coin. Last year, lawmakers and the Governor enacted tax cuts that would bring the corporate income tax to zero by the end of the decade, along with another drop in the personal income tax rate. These changes, when fully implemented, will mean the elimination of an estimated $8 billion per year in revenue — funds that will remain in the pockets of the shareholders of out-of-state corporations and the wealthiest North Carolinians.

A new low for spending as a share of the economy

The budget outlines spending $27.9 billion in FY 2022-2023, holding down investments to the smallest share of the state’s economy in recent history — 4.07 percent compared to the 45-year average of 5.8 percent. To increase North Carolina’s spending to reach this historic average, lawmakers would need to spend an additional $11.7 billion which would bring state appropriations up to nearly $40 billion, a 42 percent increase over actual appropriations. Doing so would require rolling back many of the tax cuts enacted since the General Assembly’s tax cut experiment began and which have devastated the state’s revenue.

More transfers to reserves in the face of hardship today

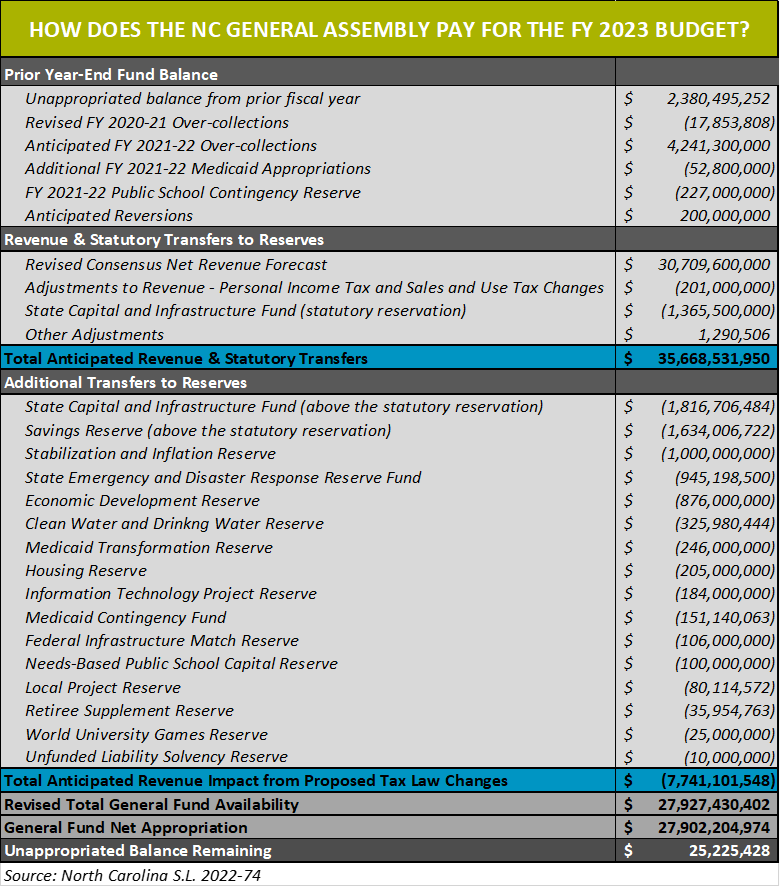

Continuing from the biennial budget enacted in November 2021, the General Assembly appropriated additional funds to the Savings Reserve (aka “Rainy Day Fund”) and the State Capital and Infrastructure Fund (SCIF) at levels well above the statutory requirements. These reserve transfers sideline money for an unknown future date while taking away funds from spending that is needed today to address hardship.

Currently, the Savings Reserve's existing balance exceeds $3 billion, and with this budget’s addition of $1.6 billion, the total will increase to approximately $4.7 billion. Meanwhile, the SCIF reserve transfers are being allocated to projects in the budget itself, and although the SCIF receipts overtime are unavailable, this budget’s allocation of $3.1 billion exceeds the transfer planned in the second year of the biennial budget and brings the biennial total transfer to the SCIF up to $6.8 billion.

In addition to transfers to the Savings Reserve and SCIF, the General Assembly made many additional allocations for specific purposes, including inflation stabilization, economic development, water infrastructure, and housing. While setting aside funds to address inflation appears to be a prudent budgeting decision, it’s unclear yet under what circumstances that legislative leaders would authorize the use of those funds, given their past reticence to use dedicated reserve funds for authorized uses and their lack of clarity about permissible uses of this latest reserve.

Missed opportunity to repeal harmful tax cuts

Unsurprisingly, lawmakers chose to keep in place the harmful tax cuts enacted last year in their two-year budget. The elimination of the corporate income tax by the end of the decade and the further reduction of the personal income tax from 5.25 percent to 3.99 percent over the next several years will hamper the state for decades to come unless these tax cuts are rolled back.

During the fiscal year that began on July 1, 2022, the state will lose $1.6 billion in revenue as the tax changes from last year begin to be implemented. As more tax cuts loom in our state’s near future, critical services that are already underfunded – public education, affordable housing, quality health care, and more — remain at risk of further cuts. These tax cuts, which overwhelmingly benefit the wealthy and corporations, will continue to harm the families who already are experiencing hardship.

Missed opportunity to advance equitable policy choices

There are two other notable omissions from the enacted budget — Medicaid expansion and meeting the requirements of the Leandro case — policies that many North Carolinians have been fighting to make happen for a decade or longer.

The enacted budget once again falls woefully short of funding a sound, basic education as set out in the Leandro court case, for which litigation remains ongoing. Analysis from the Education and Law Project at the NC Justice Center shows that the budget funds just 44 percent of what the court has deemed necessary to deliver a sound basic education. This lack of adequate, equitable investments over decades poses barriers to students’ ability to receive a quality public education, which is a constitutional right in North Carolina, but is made more difficult by the state’s poor performance in recruiting and maintaining a workforce of great educators.

While it has been an option since the 2012 passage of the Affordable Care Act, lawmakers have rejected the choice to close the coverage gap year after year. This year was no exception, but the Senate’s passage of a bill to expand Medicaid is undoubtedly the closest the state has come to adopting this common sense policy that would provide health insurance coverage to more than 500,000 North Carolinians.

A deteriorating democracy

In the span of one week, the General Assembly’s leadership managed to both introduce and enact their one-year spending plan just in time for the new fiscal year. By doing so in record time (by all accounts), they also all but excluded open dialogue on the part of other lawmakers in public forum, and once again they provided no opportunity for the public to provide input or to understand how budgeting decisions were made in any meaningful or transparent way.

Among the steps missed that would ensure a transparent process were the public cataloging of needs in North Carolina and from state agencies; review and discussion or debate of needs by legislative policy committees over the period of months; opportunity for lawmakers to put forward proposals and amendments that represent community needs; and the ability to review proposals with more than 48 hours’ notice.

This fundamental breakdown in the budgeting process, which has happened to varying degrees in many years, makes it clear that legislative leaders are no longer interested in presenting the appearance of input as they have been in previous years. What’s worse is how this legislative strategy is part of a larger strategy to grab power in a way that benefits the wealthy at the expense of everyday North Carolinians and their futures.

What’s next

Now that this year’s budget has been signed into law by the Governor, state agencies will work to implement it over the remaining fiscal year, through June 30, 2023. Beginning in this 2022 calendar year, state agencies also will take stock of their needs to ensure they can deliver services and programs in the next two fiscal years, and agencies will send their budget requests to the Governor’s office for consideration in the Governor’s budget for the upcoming biennium.

Next year, the General Assembly will come back for its long session and craft another two-year budget. For our state’s present and future, it’s imperative that lawmakers put the needs of North Carolinians first and foremost. This means rolling back these tax cuts that will harm every corner of our state as they are implemented. Instead, we must provide North Carolinians with the goods, programs, and services that they need to live prosperous and healthy lives.