Research & Data

Types

Featured

Topics

A refundable Child Tax Credit would help NC children thrive

No matter where we come from or what we look like, we all want to provide for our children and give them every opportunity to thrive. In 14 states across the country, legislatures have adopted child tax credits that reduce child poverty, improve wellbeing, and make state tax codes fairer. North Carolina should follow suit….

Recognizing the Contributions of Working Families to NC’s Economy and Communities

Working families across North Carolina contribute to our state’s economy every day through their labor in essential roles, from grocery store workers to home health aides to early childhood educators. At the same time, North Carolina’s upside-down tax code asks these families to play an outsized role in funding the public services we all want…

North Carolina should keep the income tax on corporate profits

No matter what we look like or where we live, North Carolinians want to care for our families and leave things better for those to come. But as our work has made the state prosper, a handful of politicians have rigged the rules to redirect resources from our communities to wealthy corporations who benefit from…

Economic indicators of well-being should inform policy priorities across NC

Today, the NC Budget & Tax Center published our Economic County Snapshots for 2024. Released each year, these snapshots provide at-a-glance information on a variety of economic indicators for every county in North Carolina. Why do these indicators matter for the economy? People drive our economy. At the onset of the COVID-19 pandemic, this economic…

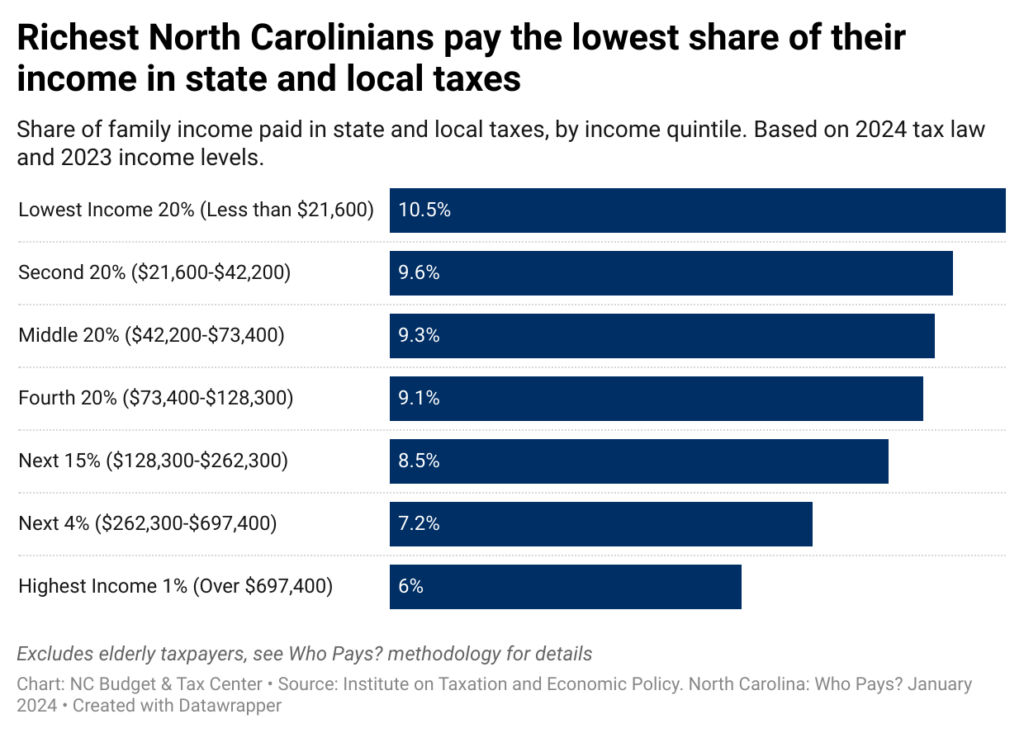

Who pays taxes in North Carolina?

As North Carolinians, we pay taxes to build communities that ensure everyone — Black, brown, and white — can thrive in every corner of our state. But policymakers in North Carolina have created a tax code that asks more of people with the lowest incomes. The latest edition of Who Pays?, released today by the…

Local tax credits are delivering for families nationwide, but not in NC

A recent report from the Institute on Taxation and Economic Policy (ITEP) is timely, then, in lifting up the potential of local governments to make transformational investments in working families through innovative policies like a local Earned Income Tax Credit. While the use of these local credits is currently blocked by state law in North Carolina, their effectiveness is a reminder of what might be possible if legislative leaders pursued policies to deliver well-being to communities across NC and empowered local governments to do the same.

What If? Considering a dedicated revenue source for the NC Housing Trust Fund

In every county and every neighborhood in North Carolina, people need safe homes for themselves and their families where they can afford to pay their rent or mortgage without cutting back on other needs like healthy food or doctor’s visits. State funding for affordable housing can help make this a reality, and the NC Housing…

NC can choose good property tax policies that support affordable housing

Property taxes are one of the ways that we come together to fund local services that we all rely on: things like school buildings for our children, health and fire departments, and parks. Homeowners and renters all contribute to property taxes; homeowners pay taxes directly while renters pay them indirectly through rent payments.

But our current property tax system in North Carolina can lead to housing displacement and perpetuate inequities, especially when a shortage of affordable housing is driving rapid increases in housing prices. Fortunately, North Carolina can adopt good policies to make the system fairer and support housing affordability without jeopardizing our public services. While we advocate for effective policies, we also need to watch out for some politicians and anti-government extremists who try to use property taxes as a wedge to push damaging property tax caps as part of an agenda to make government less effective.

Allowing sports gambling is another flawed economic decision by NC policymakers

This week, the NC General Assembly is hearing a proposal that will generate new costs for North Carolina and use our money to beef up the bottom lines of profitable companies outside our state. HB 347 would pave the way for commercialized sports betting in North Carolina, propping up a predatory industry without delivering any economic benefits.

Increase in NC’s Work First cash assistance program would help families meet basic needs

North Carolina’s Work First program benefit has stayed the same since 1996, even as the costs of rent, food and other basics have increased. A program that is meant to provide support to households in crisis and struggling to move out of poverty provides such meager cash assistance that families are still left below the poverty line.