North Carolina should fund our future by taxing corporations and the rich

No matter what we look like or where we live, North Carolinians want to care for our families and see our communities thrive. Our hard work makes the state prosper, but a handful of politicians have rigged the tax code to redirect resources from our communities to wealthy individuals and highly profitable corporations.

Federal cuts to Medicaid and SNAP (food stamps) are going into effect soon, shifting huge costs onto our state

NOW is the time for lawmakers to put North Carolina first by making corporations and the rich pay what they owe, protecting our state from federal cuts, and funding our future.

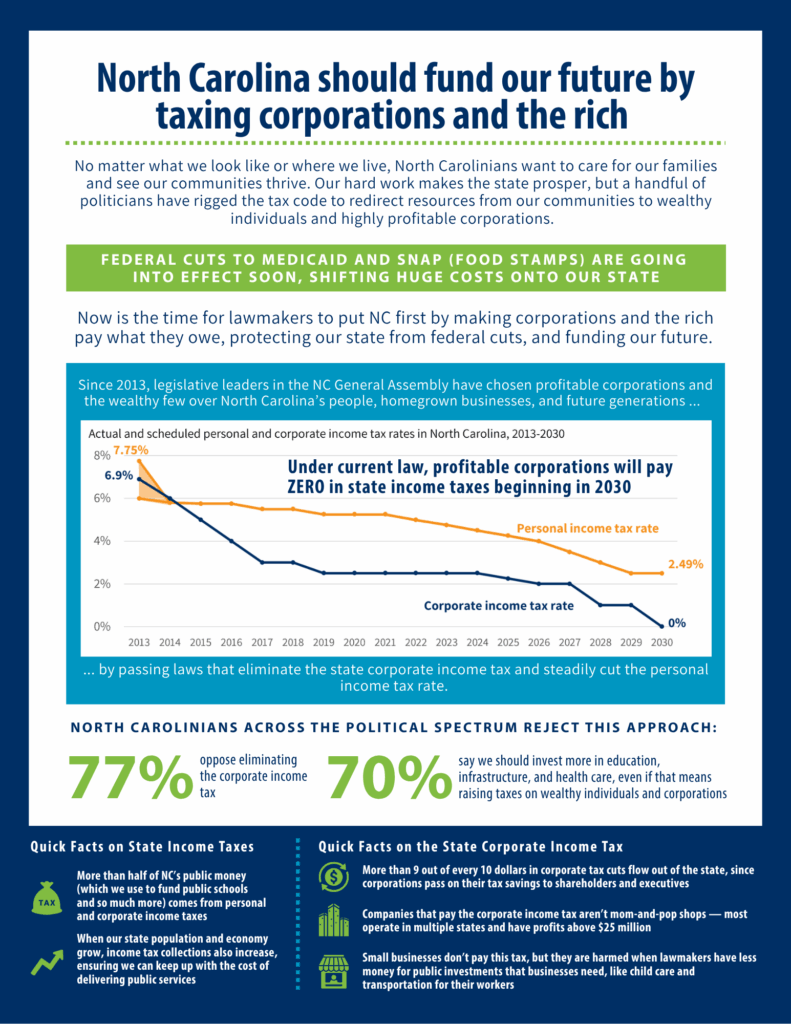

Since 2013, legislative leaders in the NC General Assembly have chosen profitable corporations and the wealthy few over North Carolina’s people, homegrown businesses, and future generations by passing laws that eliminate the state corporate income tax and steadily cut the personal income tax rate.

Under current law, profitable corporations will pay ZERO in state income taxes beginning in 2030

North Carolinians across the political spectrum reject this approach1Based on polling of registered voters in North Carolina conducted by TargetSmart in 2024.:

- 77 percent oppose eliminating the corporate income tax

- 70 percent say we should invest more in education, infrastructure, and health care, even if that means raising taxes on wealthy individuals and corporations

Income tax cuts are preventing lawmakers from lowering cost of living for families

Because of state income tax cuts since 2013, North Carolina is losing almost $18 billion in revenue each year.2Special data request to the Institute on Taxation and Economic Policy, comparing anticipated revenue from personal and corporate income taxes in 2026 to what revenue would be under 2013 tax rates.

With $18 billion more to spend in our state budget, we could:

- Make child care and housing more affordable

- Raise pay for teachers and state employees

- Give families a Child Tax Credit and Working Families Tax Credit

Instead, we’re struggling financially, and official projections show state budget shortfalls are on the horizon ... all while lawmakers keep cutting taxes for the rich and telling us they can’t find the money.

Slashing state income taxes harms regular people while enriching the wealthy few

North Carolina’s tax code is already upside-down: People with the lowest incomes pay the highest share of their income in state and local taxes. By cutting state income taxes, lawmakers are making things worse.

- In 2030, North Carolinians with incomes over $770,000 will get an annual state tax cut of $25,000 on average, on top of their federal cut from Trump and Republicans in Congress.3Special data request to the Institute on Taxation and Economic Policy, comparing personal and corporate income tax rates in 2025 to rates in 2030.

- Meanwhile, families making less than $25,000 will get a state tax cut of $34 on average — all while federal cuts to health insurance, food assistance, and more mean their everyday costs keep going up.

- With the state short on cash, local leaders feel the pressure to raise property and sales taxes, hitting folks with low incomes the hardest.

Federal cuts are hurting people and our state budget

In July 2025, President Trump and Republicans in Congress passed a harmful megabill that slashed Medicaid and SNAP, and takes away tax credits that help people afford to buy health coverage on their own when their employers don’t provide it . Why? So they could give massive tax cuts to people making over $500,000.4Center on Budget and Policy Priorities, House Republican Tax Bill Is Skewed to Wealthy, Costs More Than Extending 2017 Tax Law, and Fails to Deliver for Families.

Here are some impacts in NC:

- Health insurance premiums will double on average next year for people who buy health coverage on their own5This applies to Affordable Care Act (ACA) marketplace enrollees who receive Advanced Premium Tax Credits, which was over 92 percent of enrollees nationwide in 2024. See KFF, Inflation Reduction Act Health Insurance Subsidies: What is Their Impact and What Would Happen if They Expire?

- Half a million people expected to lose health coverage by 20346Center on Budget and Policy Priorities, Estimated Increase in Uninsured Due to 2025 Reconciliation Law and Expiration of Enhanced Premium Tax Credits.

- Medicaid and SNAP taken away from lawfully present immigrants7National Immigration Law Center, The Anti-Immigrant Policies in Trump’s Final “Big Beautiful Bill,” Explained.

- Six rural hospitals at risk of closure due to Medicaid cuts8American Hospital Association, Rural Hospitals at Risk: Cuts to Medicaid Would Further Threaten Access

- 1,400 food retailers at risk of closure, mostly in rural areas, due to SNAP cuts9Center for Healthcare Quality & Payment Reform, Rural Hospitals at Risk of Closing and Center for American Progress, SNAP Cuts Are Likely To Harm More Than 27,000 Retailers Nationwide.

- Clean energy cuts mean annual household energy costs will go up by nearly $500 over the next ten years, and over 40,000 jobs lost in 203010Energy Innovation, Economic Impacts of the U.S. “One Big Beautiful Bill Act” Energy Provisions on North Carolina.

Let's tell our lawmakers to fund our future by taxing the rich and profitable corporations!

There’s still time to stop reckless income tax cuts in North Carolina. Our state needs corporations and the rich to pay what they owe so that workers, homegrown businesses, and communities have what we need to drive our economy forward.

Quick Facts on the State Corporate Income Tax

- More than 9 out of every 10 dollars in corporate tax cuts flow out of the state, since corporations pass on their tax savings to shareholders and executives11Special data request to the Institute on Taxation and Economic Policy

- Companies that pay the corporate income tax aren’t mom-and-pop shops — most operate in multiple states and have profits above $25 million12North Carolina Department of Revenue Tax Research & Equity Division, Corporate Income and Business Franchise Taxes: Statistics and Trends Tax Year 2022.

- Most small businesses don’t pay this tax, but they are harmed when lawmakers have less money for public investments that businesses need, like child care and transportation for their workers.13Corporate income taxes only apply to businesses organized under a specific legal structure, and most businesses don’t use this structure. For more information see Tax Policy Center, How does the corporate income tax work?.

Quick Facts on State Income Taxes

- More than half of NC’s public money (which we use to fund public schools and so much more) comes from personal and corporate income taxes14North Carolina Department of Revenue, Tax Processing, Research & Equity Division, Statistical Abstract of North Carolina Taxes, 2024 Advance Edition.

- When our state population and economy grows, income tax collections also increase, ensuring we can keep up with the cost of delivering public services15Institute on Taxation and Economic Policy, The ITEP Guide to State & Local Taxes: How Do Personal Income Taxes Work?