For the love of taxing corporations: Most everyone agrees — eliminating the corporate income tax is a bad call

In 2013, the NC legislature started cutting taxes (mostly for big corporations and wealthy people). Most years since have NC lawmakers continue to divert public funds from things like schools, childcare, broadband, water quality, and public safety, to the pockets of out-of-state corporations and the wealthy few. These cuts also put more of the burden on middle- and low-income taxpayers while letting their richer neighbors off the hook. This post is part of a series bringing light to how tax cuts have failed to deliver promised benefits while undermining our ability to pay for things North Carolinians need.

Reaching consensus on anything these days seems like something out of a fairy tale. Families have fallen out over what you can do during the national anthem, student loan forgiveness has the generations at each other’s throats, and of course the vinegar/ketchup barbeque debate rages on.

Turns out we can agree after all. As we take stock of things we cherish on Valentine’s Day, corporate income taxes count among the most beloved policies we have.

A recent poll showed that North Carolinians — of all political stripes, races, ages, genders, and even parts of the state — are stone-cold opposed to eliminating the corporate income tax.

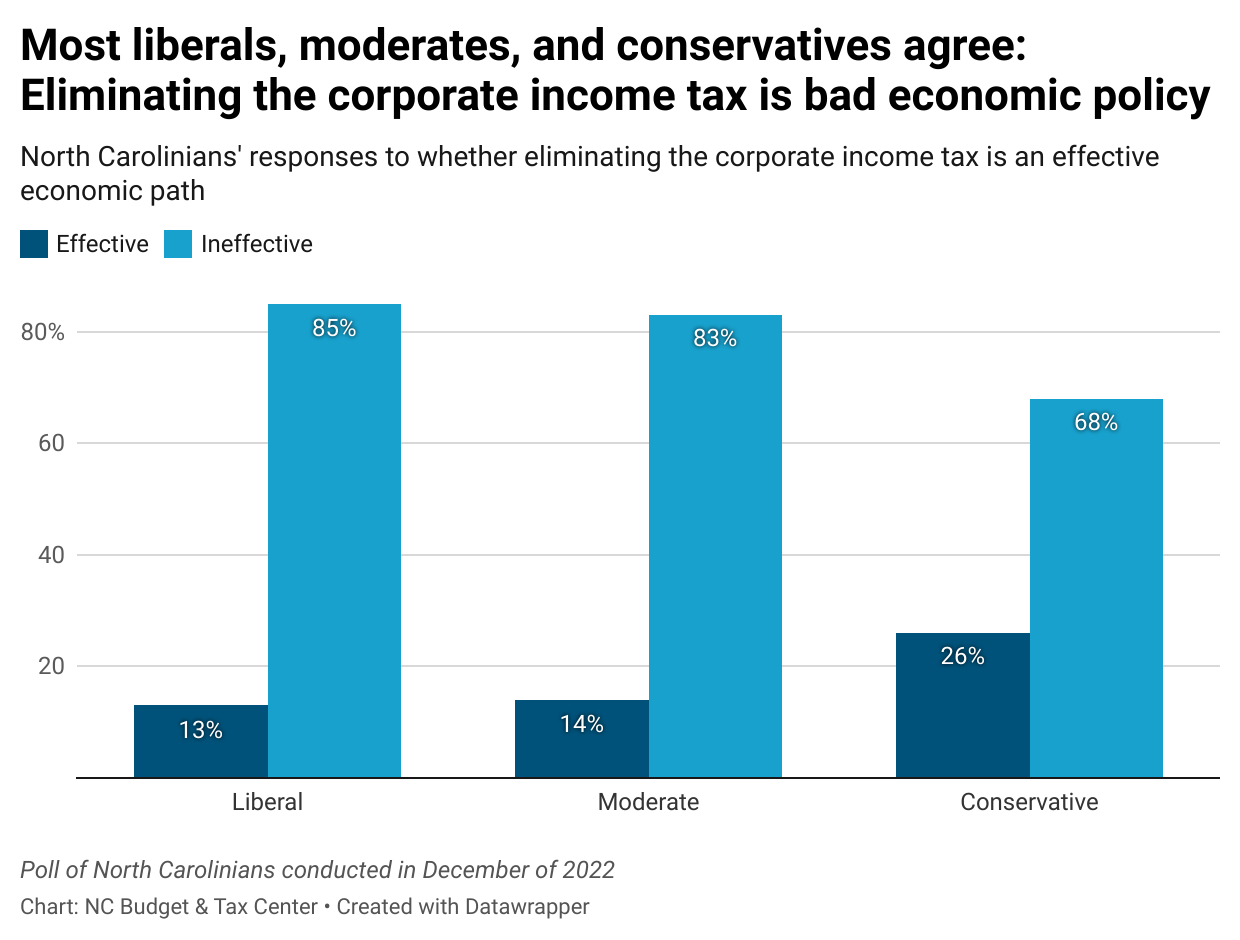

Perhaps most strikingly, support for the corporate income tax is one thing conservatives and liberals, and Biden and Trump voters, see eye to eye on. Nearly 70 percent of conservative North Carolinians think eliminating the corporate income tax is ineffective economic policy, only a little lower than the 85 percent of liberals (the answers were nearly identical for Biden and Trump voters respectively).

Opposition to eliminating the corporate income tax dominates across every other group surveyed, including:

- 79 percent of women and 75 percent of men

- 78 percent of rural, 76 percent of suburban, and 81 percent of urban residents

- 71 percent of Black and 80 percent of white North Carolinians

- 80 percent of people between 18 and 34 years old and the same share of people over 50

The level of skepticism about eliminating the corporate income tax is even more striking in comparison to what North Carolinians think we should be investing in. When asked what we should do with the billions of dollars the state has sitting on the sidelines, people had a long list of priorities that came ahead of giving the money to corporations.

While only a quarter of respondents thought we should divert public funds into corporate coffers, at least 80 percent believe we need to pay our teachers better, provide affordable child care and work force training, build affordable housing, and invest in our schools, water infrastructure, and broadband.

In spite of how massively unpopular it is, legislative leaders still have us on a path to eliminate the corporate income tax, and some have even floated the idea of making it happen faster. That means the voices behind the results we saw in this poll need to be heard in Raleigh. Legislators need to hear the depth of displeasure that North Carolinians feel about giving our money to already wealthy companies. Let’s make good on an area where genuine consensus exists and make sure that wealthy corporations pay what they owe.