Reflections on a summer internship with the NC Budget & Tax Center

This summer, we’ve been lucky enough to have two great interns, Jennifer Nguyen and Selene Santiago-Lopez. Jennifer is a Master of Public Policy candidate at the Sanford School of Public Policy at Duke University, and she worked with us as a Policy Analyst Intern. Selene is a UNCG alum with a bachelor’s in International and Global Studies and Women, Gender, and Sexuality Studies.

As the summer draws to a close, we’ve asked them to share their thoughts about their time with us over the past few months.

Why did you want to intern with the Budget & Tax Center (BTC), and how did it fit into your career goals?

Jennifer Nguyen

Jennifer: Prior to interning at BTC, I had taken a Tax Policy course that opened my eyes to how budget and tax policies can make the difference in income, education, and health disparities – and thus one’s quality of life. Hence, BTC was the perfect opportunity for me to learn how to unravel existing racial and economic injustices. In particular, I was interested in BTC’s emphasis on communities’ lived experiences as I aim to promote community-informed policies throughout my policy career.

Selene Santiago-Lopez

Selene: One of the key issues that resonated with me about BTC was bringing greater transparency to the public policy and budgeting process. I’ve had experience when it came to electoral campaigns that advocated certain issues impacting our communities. However, I had never really thought about how policies enable and disable these forms of inequities. That’s why I have always been interested in learning more about how those policies go into effect. Moreover, I had never had any exposure to the money side of things. I’m happy I found this opportunity to learn more but also to create that transparency that will continue to make this process accessible to our community members.

What’s your favorite thing that you got to work on or participate in?

Jennifer: My favorite assignment during the internship was a quantitative analysis of property tax data at the county and municipal level from 2020 to 2024. Though I possessed quantitative analysis skills going into the internship, I had never had the opportunity to work with such an expansive amount of data. Also, in navigating the property tax data, I also gained insight into factors that determine the effective property tax rate that owners actually pay.

Selene: I enjoyed supporting Dani Hoffpauir (BTC Community Building & Program Manager) in organizing this year’s 2024 Summer Policy Institute (SPI)! It was an amazing opportunity to be in a space with community members who were empowered and vocal about the issues surrounding public policy, taxes, and the budgeting process on a local level. I was able to interact with our partners and the 2024 SPI cohort to learn about the ways they are showing up for their communities and how they’ll continue to center communities in policymaking.

What’s one new thing you learned?

Jennifer: I was assigned to draft a fact sheet on the Temporary Assistance for Needy Families (TANF) family cap. The family cap policy disqualifies families from receiving additional benefits when they have more children after they enroll in TANF. I was so disconcerted as to why the state would deprive poor families of the assistance they need and would otherwise qualify for that I had to verify with my supervisor if I was understanding the policy correctly.

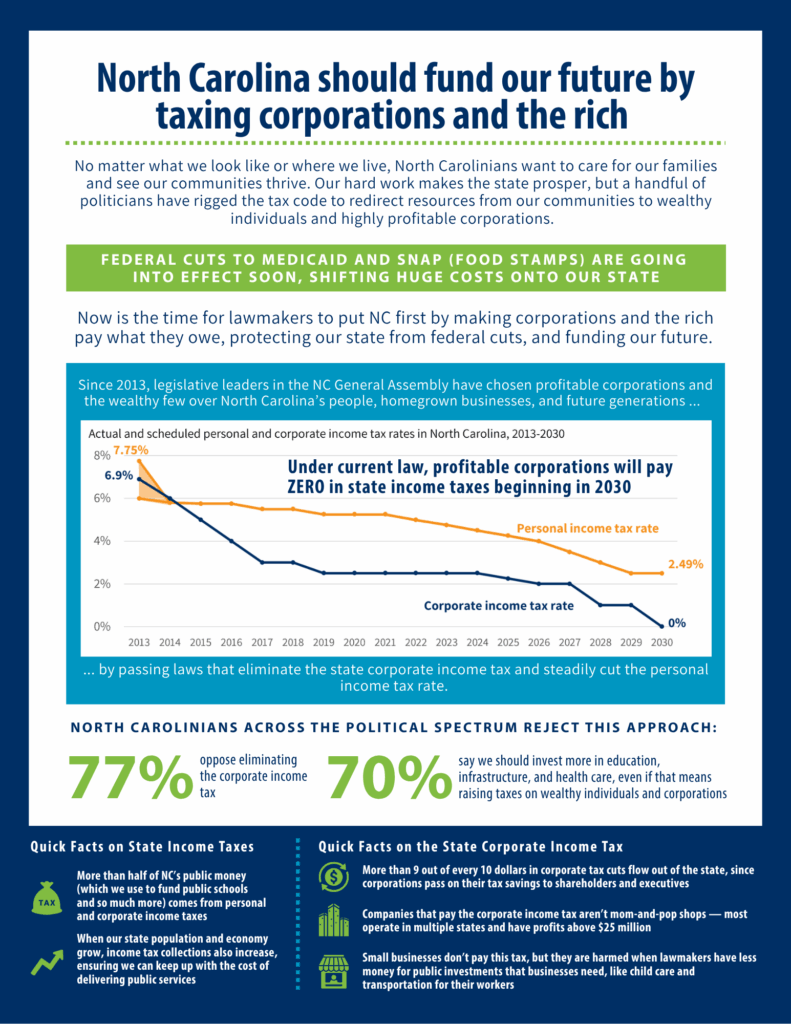

Selene: I learned about the history of tax choices that have shaped NC to the present day. This has been one of the most impactful pieces of information that I have encountered because it has shown me how skewed tax choices have been toward certain populations that have historically left them at a disadvantage. Moreover, this has allowed me to look at our state in a different light and piece together the systemic reasons why our communities struggle to thrive economically.

What’s one thing that surprised you?

Jennifer: I was pleasantly surprised with how thoughtful and intentional BTC is with defining its policy priorities, strategies, and roles. Though the staff does recognize how challenging it would be to accomplish some of the policy aims in the current political environment, I found their persistence in fighting for North Carolinians’ basic needs to be inspiring.

Selene: I was surprised at how significant the tax and budget processes are when examined from an intersectional framework. These processes impact every aspect of our livelihoods, especially at a policy level which can either continue to reinforce disparities or challenge them. This was depicted in how legislation is approached and enacted through legislators, policymakers, advocates, and community members.