As legislative session starts, a timeline of tax cuts in North Carolina

In 2013, the NC legislature started cutting taxes (mostly for big corporations and wealthy people). Most years since have NC lawmakers continue to divert public funds from things like schools, childcare, broadband, water quality, and public safety, to the pockets of out-of-state corporations and the wealthy few. These cuts also put more of the burden on middle- and low-income taxpayers while letting their richer neighbors off the hook. This post is part of a series bringing light to how tax cuts have failed to deliver promised benefits while undermining our ability to pay for things North Carolinians need.

North Carolina used to be a place where rich people and big corporations pulled more of their share of the load. Profitable companies paid what they owe through a reasonable corporate income tax, and people with higher incomes chipped in their share to fund schools, clean drinking water, safe communities, and the other vital services government provides. Legislative leaders started going in a very different direction in 2013, and they have floated the idea of even more cuts this year.

Over the next several weeks, we’ll review the poor track record of cuts since 2013, which also gives us a pretty good sense of what to expect unless legislative leaders are compelled to change course.

Let’s take a look at the direction the legislators have pushed tax policy in the past decade and where they may be trying to go this year.

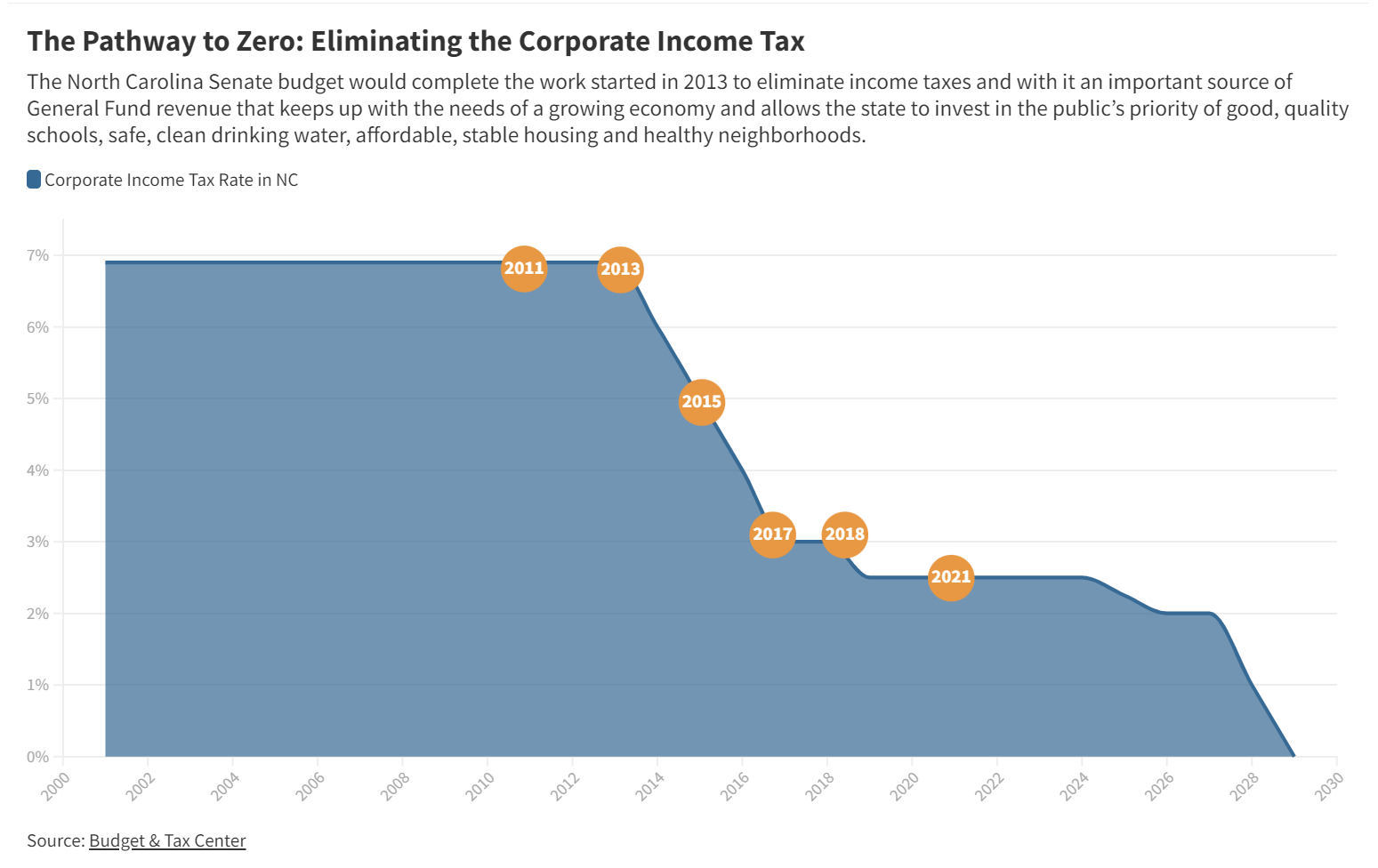

Eliminating the corporate income tax entirely

North Carolina used to require profitable corporations to pay a reasonable tax rate of almost 7 percent, but that has been steadily chipped away to only 2.5 percent now. What’s more, the budget that lawmakers passed in 2021 scheduled the rate to go to zero by 2030.

Some legislators have suggested accelerating the elimination of the corporate income tax and other cuts that primarily benefit large multi-state companies while doing nothing to support most locally owned businesses.

Diverting our public dollars to the wealthy few

North Carolina used to have a graduated income tax structure where people paid a higher rate on income over certain high thresholds: A tax rate of 7.75 percent to apply to income over $100,000 for couples filing jointly, while people with lower incomes paid a lower rate.

The first major changes in 2013 created a flat income tax rate of 5.8 percent, and that rate has been falling to where it currently sits under 4 percent. The biggest beneficiaries of these cuts have been people with higher incomes, leaving more of the tax load on North Carolinians who can least afford it.

Tax cuts have failed to address the real challenges North Carolinians face, so it’s time to come together and demand a change of course, not more of the same. When our elected leaders make wealthy corporations and the richest few pay what they owe, we will have what we need for everyone in NC to thrive.